China’s latest economic data put the government’s growth goal of about 5% well within reach and lessened the likelihood for more stimulus before the end of 2023. But the ongoing housing crisis remains a serious drag, clouding the outlook for next year.

While third-quarter gross domestic product figures released Wednesday surpassed expectations on strong consumer spending, the data points to difficult months ahead for the world’s second-largest economy as efforts by President Xi Jinping’s government to stabilize the property sector and avert deflation have shown little effect.

China’s economic challenges come in the face of persistent geopolitical tensions, as the US tightens curbs on advanced technology and Europe probes the country’s export dominance in electric cars. Economists surveyed by Bloomberg expect China’s growth in 2024 to slow to 4.5%.

The boost to headline domestic growth from consumer spending on retail sales services will fade once the comparison to lockdown-hit 2022 is in the rearview mirror. That means China’s leadership will need to consider policy support to keep growth humming well into next year.

“There is no big pressure on achieving this year’s about 5% growth target,” said Miao Ouyang, greater China economist at BofA Global Research. While that goal that was set in March had been in doubt earlier this year, government officials on Wednesday said they are now “very confident” the economy will reach it.

“Any policy support to be provided now doesn’t just impact on this year’s growth,” Ouyang said, adding that potential further easing in the near term will influence growth assessments through the first half of 2024.

Consumer Boost

The biggest upside surprise in Wednesday’s data came from retail sales. The figures showed a recovery in spending on everything from restaurants and alcohol to cars last month as compared to 2022, when coronavirus restrictions were in force nationwide. China’s unemployment rate fell to 5% and household savings rates declined, suggesting a tighter labor market is making consumers more confident.

That contributed to GDP growing 4.9% July-to-September period compared to 2022 and 1.3% compared to the prior quarter — leading investment banks from Citigroup Inc. to Nomura Holdings Inc. to raise their economic forecasts for 2023.

“China’s GDP growth was a strong beat,” the Citi economists wrote, “perhaps representing the strongest confirmation of the cyclical bottom.” They raised their growth projection for this year to 5.3% from 5% after the data.

With Washington and Beijing increasingly seeing economic growth in competitive terms, Xi’s economic team will probably relieved by comparisons with the US. China’s growth in the third quarter equated to an annualized rate of 5.3%, which beats the consensus prediction for US annualized GDP growth of 4.1%.

The world should also feel a boost as the two largest economies outperform expectations formed earlier this year. Xi emphasized global interconnection on Wednesday as he opened a forum in Beijing marking the 10th anniversary of the Belt and Road Initiative, China’s landmark infrastructure project.

“China can only do well when the world is doing well,” Xi said. “When China does well, the world will get even better.”

What Bloomberg Economics Says ...

“The latest batch of data on China provide some a relief, but aren’t a cause for celebration. Faster-than-forecast GDP growth showed the recovery picked up speed in 3Q. Yet September’s weak momentum in production and consumption calls into question whether it will continue in 4Q — and indicates the need for more policy support.”

— Chang Shu and David Qu, economists

Read the full report here.

Pessimism Remains

The ongoing property slump, though, is making economists downbeat about the outlook for next year. That’s mainly because of doubts that the country will find growth sectors sufficiently large to offset the drag from shrinking property construction. Combined with related industries, it’s thought to account for as much as 20% of GDP.

“Property is the main concern,” said Larry Hu, chief China economist at Macquarie Group Ltd. He expects growth to slow to 4.7% next year. “After falling for more than two years, I tend to think the drag will be less next year. But I can be wrong. Even if I am right, the road will be bumpy.”

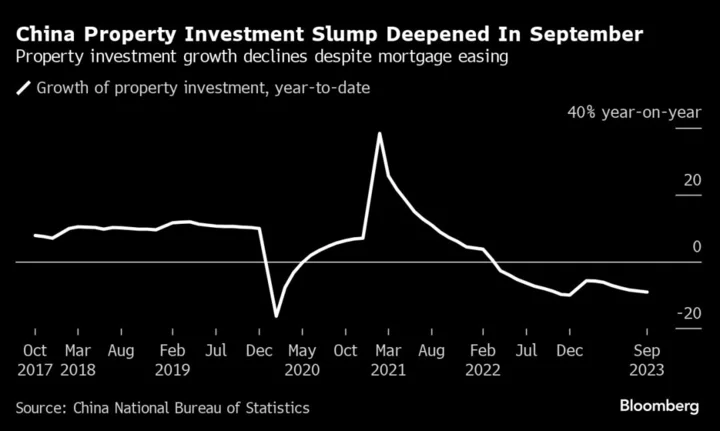

Property investment — a key driver of economic activity — contracted 9.1% in January-to-September from a year ago, official data showed Wednesday, a bigger drop than in the first eight months of the year. That came even as China broadly relaxed downpayment requirements in the largest cities late last month.

Households appear to be cautious about buying homes as an ongoing liquidity crunch among developers — symbolized by looming default at Country Garden Holdings Co., once China’s top developer — makes them worried about whether homes will be completed. Households are also pessimistic on property prices, and so are shifting their savings from housing into bank deposits.

While sectors including electric cars, microchip manufacturing and renewable energy are doing well, “we aren’t so convinced that the economy can so quickly end its dependence on property,” said Paul Cavey, an economist at East Asia Econ. The move of corporate and household money into time deposits, combined with what he called “persistent data inconsistencies,” is keeping him unconvinced of a recovery in consumption.

In another warning sign stemming from housing market troubles, China’s deflator — an economy wide measure of prices — was negative for a second consecutive quarter. That’s the first time that’s occurred since 2015, according to Bloomberg calculations based on official data. The price declines are a sign of weak demand stemming largely from the property downturn, according to economists.

Pessimism about the real estate sector was one reason the International Monetary Fund this month lowered its forecast for China’s 2024 growth to 4.2%. The nation’s real-estate woes require a “forceful” response by officials there to restore confidence, the Fund added.

More Support

There may be more government support to come. Economists expect China to further cut interest rates and the reserve requirement ratio for banks this year.

China said last week it would consider revising a law allowing it to assign local government bond quotas mainly used for infrastructure investment in advance. Economists said that move gives Beijing flexibility to introduce further stimulus at the end of this year or early next.

Goldman Sachs Group Inc. economists predict that as much as 500 billion yuan ($68.4 billion) of unused bond quotas could be assigned this year. Beijing has signaled plans to redevelop urban areas, and to use bond issuance to help local governments lower debt burdens.

“Policy efforts may be stepped up moving forward, especially for early next year, with focus on old-village redevelopment, local debt resolution, fiscal expansion,” Citi economists led by Xiangrong Yu said in a note.

--With assistance from Fran Wang.

(Updates with line about economist expectations for policy.)