China is taking targeted steps to help specific sectors of the economy, like property and manufacturing, suggesting more broader stimulus measures like interest rate cuts could be off the table for now.

The State Council, China’s cabinet, announced a limited economic package on Friday to boost consumption of electric vehicles, pledging to extend tax exemptions on purchases. Officials are working on a new basket of measures to support the ailing housing market as well, according to people familiar with the matter. Tax breaks for high-end manufacturing companies are also being planned.

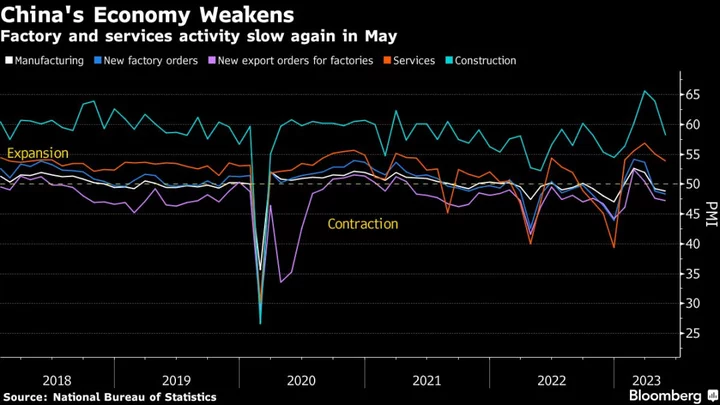

Economists said the moves suggest Beijing will tailor its support toward industries that require a boost, and broad measures like interest rate cuts or a major ramping up in fiscal policy were unlikely. It remains to be seen, though, whether the planned steps would be enough to spur the recovery after a string of key indicators recently pointed to a slowdown.

“The most-asked question these days is ‘will the Chinese government stimulate the economy,’” Hui Shan, chief China economist at Goldman Sachs Group Inc., wrote in a note. “Our answer is yes (for targeted areas) and no (for major broad-based stimulus).”

The government set a relatively conservative growth target of around 5% for the year, which most economists expect will be achieved even with the recent slump in activity. Consumer spending on travel and restaurants continue to drive the economy’s recovery, with data Monday showing a further jump in services activity.

Morgan Stanley said the slowdown in the recovery in the second quarter was a “hiccup” and it expects growth will reach 5.7% for the full year. Policy will remain supportive, the economists said in a report, with Beijing likely to ease property rules, invest a further 1 trillion yuan ($141 billion) in infrastructure and give more targeted consumer incentives.

Calls have increased recently for the government to take more concerted steps to spur the recovery. Financial markets and commodity prices slumped last week after the disappointing data, although news of the property easing measures on June 2 helped to lift sentiment for local stocks.

Larry Hu, head of China economics at Macquarie Group Ltd., said there’s still need for more central bank stimulus, with a possible reduction in the reserve requirement ratio for banks in coming weeks.

“More easing measures are needed to stabilize the economy,” he said. “Given the weak data in April and May, I expect more easing measures to come through in the coming weeks, including a RRR cut, an acceleration in infrastructure spending and more relaxation in property policy.”

While a RRR cut is highly likely in June, an interest rate cut is a “hard call” given the Federal Reserve is still hiking interest rates, he added.

The People’s Bank of China has refrained from cutting interest rates this year and Beijing has been reluctant to sharply increase fiscal spending, concerned by financial stability risks after local government debts soared.

ANZ’s senior China strategist, Xing Zhaopeng, said Beijing doesn’t want to over-stimulate the so-called old economy sectors, like construction, but is focusing its support on new sectors, such as EVs. The State Council’s measures are in line with the Politburo meeting in April, he said, where senior officials pledged to step up support for the private sector.

Xing said the chance of any interest rate cut is slim, although it’s still possible for the PBOC to lower the reserve ratio for banks sometime this year, likely by 25 basis points.

--With assistance from Yihui Xie.