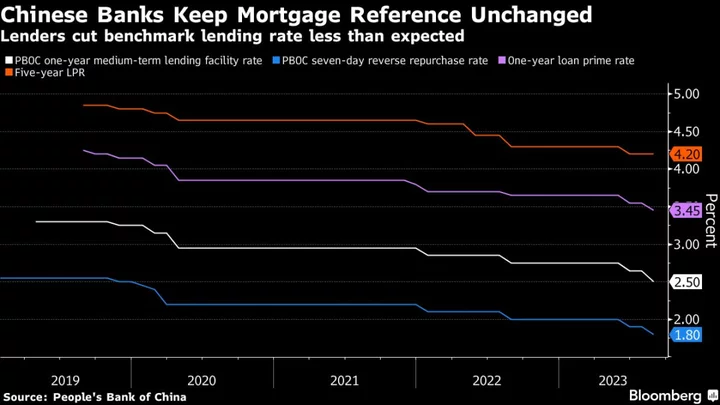

Chinese banks made a smaller-than-expected cut to their benchmark lending rate on Monday and avoided trimming the reference rate for mortgages, despite the central bank putting pressure on lenders to boost loans.

The one-year loan prime rate was lowered by 10 basis points to 3.45% from 3.55%, a slighter reduction than what most economists surveyed by Bloomberg had expected. The five-year rate, a reference for mortgages, was unexpectedly kept steady at 4.2%, according to data from the People’s Bank of China. Most economists had predicted a 15 basis-point cut.

“This is a surprising result, showing that banks are not well prepared. We believe the cuts will continue in the next few months,” said Zhaopeng Xing, senior China strategist, Australia & New Zealand Banking Group Ltd.

The loan rates are based on the interest rates that 18 banks offer their best customers, and are published by the PBOC monthly. They are quoted as a spread over the central bank’s one-year policy rate, or the medium-term lending facility rate, which was cut by 15 basis points earlier this month — a surprise move that marked the steepest reduction since 2020.

Stocks in China and Hong Kong declined at the market open on Monday. The MSCI China Index slid as much as 1.1% to its lowest since June 1. The offshore yuan extended a modest decline against the dollar, weakening about 0.2%. China 10-year bond yields fell one basis point to 2.55%.

Recent economic data showed a slump in borrowing demand, deflation pressure and falling export orders in July, prompting several banks to cut their growth forecasts for the year to below 5%. Investors are also concerned about contagion risks following a liquidity crisis at a major shadow bank.

The central bank and financial regulators met recently with bank executives and told lenders again to boost loans to support a recovery — yet another sign of how concerned policymakers have grown about the deteriorating economic outlook.

Even so, the unexpectedly small actions on Monday send a signal “that authorities don’t want the property market to overheat,” said Bruce Pang, chief economist and head of research for greater China at Jones Lang LaSalle Inc.

“There has been speculation on whether the government will completely let loose property policies after the Politburo meeting omitted the pledge that housing is not for speculation,” he said, referring to a meeting held last month by the Communist Party’s top decision-making body. The absence of that slogan, a signature of President Xi Jinping, fueled speculation that some tough restrictions on property would be reversed.

“The signal now is that there will still be policy controls on the property sector, just that they will be optimized,” Pang said, adding that authorities have also introduced a mechanism for lowering new mortgage rates already, lessening the need to adjust the five-year LPR.

Policymakers may also have judged that cutting the mortgage reference rate “is not the most effective tool,” said Frances Cheung, rates strategist at Oversea-Chinese Banking Corp Ltd.

“Either that’s it, or the regulators are mulling something more substantial in supporting the property sector,” she added.

Many economists expect the PBOC to reduce the reserve requirement ratio for banks and further trim interest rates in coming months.

--With assistance from Qizi Sun, Cormac Mullen, Tan Hwee Ann and Paul Dobson.

(Updates throughout.)