Shares of Chinese companies traded in the US recorded their biggest one-day advance since early January after top leaders in Beijing vowed more support for the struggling economy and signaled a stance change toward the real estate industry.

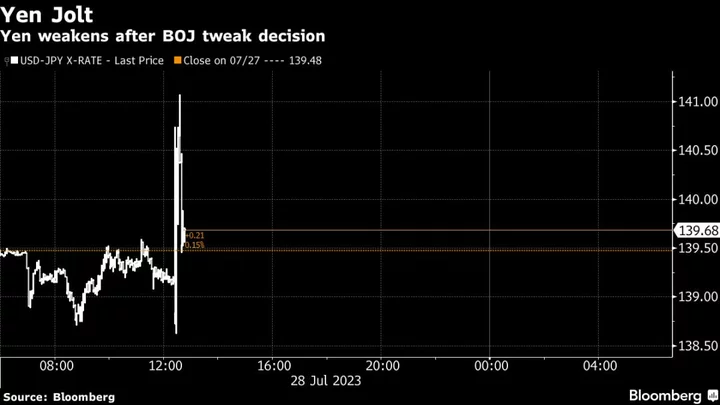

The Nasdaq Golden Dragon China Index rose as much as 5.5% Monday, with big-cap technology names including Alibaba Group Holding Ltd. and Baidu Inc. rising around 6% or more. KE Holdings Inc., a housing transactions platform operator, jumped more than 10%, the most since November. The Chinese currency was also boosted by the broad optimism, with the offshore yuan erasing its losses against the dollar on the day.

The gains may bode well for the Chinese stocks when markets open in Asia. Future contracts on Hong Kong’s benchmark Hang Seng Index rallied 3%, with the $7.9 billion iShares MSCI China ETF (MCHI) gaining by the same amount.

While stopping short of announcing any broad-scale stimulus measures, the ruling Communist Party’s top decision-making body signaled more support for the troubled housing market after a slew of data indicated that China’s post-Covid recovery has lost momentum. The 24-member Politburo left out the slogan of “housing is for living, not for speculation” in a readout following its mid-year review of the economy, a sign that authorities may have been considering easing restrictions on the industry.

China Holds Off on Major Stimulus as It Signals Property Easing

The Politburo meeting earlier “was more dovish than expected, promising housing easing, local debt resolution, and a boost to capital markets,” wrote Morgan Stanley economists led by Robin Xing in a note to clients. This could be a “defining moment,” akin to October 2018, they added. “We thus expect further relaxation of home purchase restrictions in Tier-1 cities, to release pent-up demand and stabilize market expectations.”

The Wall Street bank now expects a meaningful growth rebound in the fourth quarter, keeping full-year growth at the government’s target of 5%.

The rally in Chinese stocks came after a 2.1% drop in the Hang Seng Index on Monday, led by declines in property builders, after analysts at JPMorgan Chase & Co. turned bearish on Country Garden Holdings Co. due to liquidity concerns.

Analysts have said that Chinese stocks are prone to sharp rebounds as they trade at depressed valuations. The MSCI China Index is at about 10 times its forward one-year earnings, a multiple that is one standard deviation below its five-year average level.

“The markets are set to respond” to the latest news out of the meeting even without detailed measures being announced, said Hao Hong, chief economist at Grow Investment Group. “Removal of the ‘housing isn’t for speculation’ slogan is significant,” he added, “But investors need to know how this can be followed through in policy.”

“The Chinese economy needs real estate in the near term to recover, but also needs to wean it off for the long run,” said Hong. “Just like an old Chinese proverb puts it: It takes a poison pill to cure a disease.”