It says something about the popularity of Colombia’s government that a political scandal which threatens to undermine the president sends the currency to a 10-month high.

The peso leaped as much as 1.6% Monday, the biggest gain among major emerging-market currencies, pushing it to the highest since August as the leftist president struggles to contain the fallout from the latest events. The currency is now the best performing among developing nations this year.

President Gustavo Petro is under fire after his former ambassador to Venezuela and campaign chief threatened to reveal dirt about how the 2022 presidential bid was funded. The foul-mouthed tirade, published by Semana Magazine on Sunday, led Lower House leader David Racero on Monday to say that discussion of reforms would be halted until the ruling coalition is “rebuilt.”

“Markets are comfortable with the Petro administration starting to crack,” Brendan Mckenna, a currency strategist at Wells Fargo said. “If Petro’s reform agenda is unable to be implemented and Petro is essentially in a lame duck scenario, that combination takes a lot of political risk off the currency.”

Petro is seeking to overhaul the conservative economic model with three structural reforms to the health and pension systems and the labor market. Time is fast running out though as the legislative period ends in less than three weeks.

Read more: Scandals Paralyze Petro’s Bid to Overhaul Colombia Welfare State

The peso is also benefiting from solid fundamentals that have sent it up 13% year to date, surpassing gains in the Mexican currency.

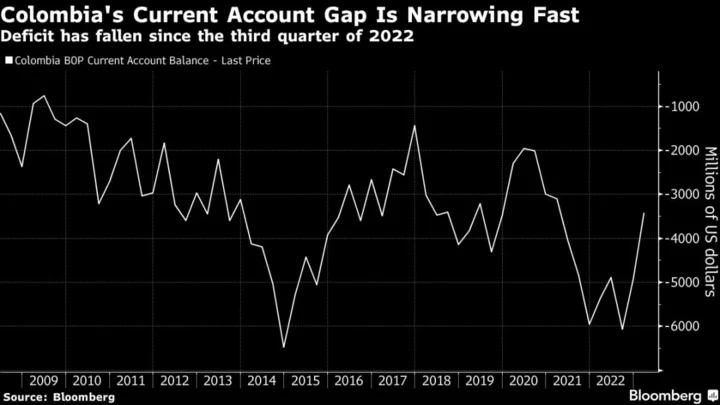

The fiscal and current account deficits are “falling very fast, and the likelihood of major structural reforms to social security that would put upward pressure on fiscal spending has decreased materially in the past few weeks.”, said Armando Armenta, a senior economist at AllianceBernstein in New York, who has favored Colombian assets since last October.

While the Mexican peso is still top of the risk-adjusted carry trade in Latin America, Colombia is significantly more attractive than Chile and is currently head-to-head with the Brazilian real for the post of second best in the region. The central bank’s persistently hawkish tone has also reassured investors that the juicy carry will be maintained.

--With assistance from Maria Elena Vizcaino.