Fears about the health of the US consumer this week from companies across the country — ranging from used-car dealers and restaurant operators, to airlines and major retailers — are raising concerns in the stock market about the chances for a soft landing.

The confidence of US shoppers, which seemed indomitable until very recently, is a key underpinning of the bullish expectation that the US economy might avoid a recession, despite the Federal Reserve’s aggressive interest-rate hikes. But now signs are emerging that consumers may be feeling the pinch.

Used-car dealer CarMax Inc. on Thursday said that some of its customers “are going down to a different level of car” in order to afford monthly payments. Retailer Costco Wholesale Corp. earlier in the week flagged that its discounts on big-ticket discretionary items failed to fuel as much demand as it had expected. Meanwhile, airline JetBlue Airways Corp. issued an earnings warning, noting there were fewer leisure travel bookings in September. And last week, Darden Restaurants Inc. said some of its consumers are trading down to lower-priced alcohol compared to last year.

“The triple whammy of higher interest rates, higher energy prices, and the restart of student loan repayments, are all likely to weigh on the consumer, especially the lower-end income cohort,” said Keith Lerner, co-chief investment officer at Truist Advisory Services. That can make the economy “harder to land.”

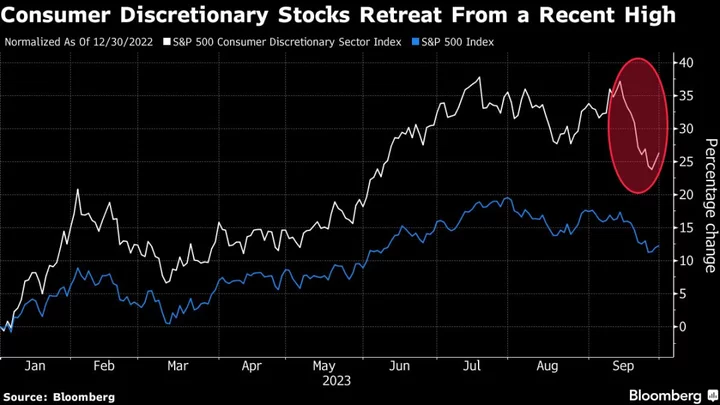

The S&P 500 Consumer Discretionary Sector Index has fallen 7.6% over the past two weeks, with the declines led by CarMax, Carnival Corp. and Amazon.com Inc. That compares to a 4.1% drop in the S&P 500 Index. Meanwhile, personal consumption, the main driver of the US economy, rose at the slowest monthly pace since late 2020 in August and US consumer confidence dropped to a four-month low in September.

Read More: Citi Sees Cracks Forming in US Consumers With Low FICO Scores

The signs of thinning confidence come amid a warning from Morgan Stanley’s Michael Wilson on Monday, who said that risks are rising for consumer stocks, noting the resumption of student loan payments, rising delinquencies in certain household cohorts, higher gas prices and weakening data in the housing sector.

Though initial weakness has started to show, some proponents of the soft landing scenario are still undaunted. Bank of America Corp. Chief Executive Officer Brian Moynihan said his firm’s strategists still expect a soft landing for the US economy, spurred by continued strength in consumer spending.

Others point to the resilience of the labor market and the strength in wages. There were also some bright spots among corporates, with sneaker-maker Nike Inc. reporting “better than feared” results and cruiseline operator Carnival noting increased demand for travel in America.

“There’s a risk that the US consumer is not as strong as we think,” Ned Davis Research’s chief economist Alejandra Grindal wrote in a note to clients. However, the good news is that real wages are rising and by some measures, are back to pre-pandemic growth rates. “This should support consumer spending,” she said.

--With assistance from Janet Freund and Katrina Compoli.