Shares of cryptocurrency and blockchain-related companies fell in premarket trading on Tuesday after the industry's biggest exchanges Coinbase Global and Binance found themselves in the crosshairs of the U.S. securities regulator.

The U.S. Securities and Exchange Commission sued Coinbase, accusing it of illegally operating without registration with the regulator. The SEC also filed a lawsuit against Binance and its CEO, Changpeng Zhao, on Monday.

In a complaint filed in Manhattan federal court on Tuesday, the SEC said Coinbase has since at least 2019 operated as an unregistered broker by handling cryptocurrency transactions, evading the disclosure requirements meant to protect investors.

Coinbase shares fell 16% in premarket trading, while Blockchain farm operator Bitfarms' stock dropped 4.5%.

Bitcoin, the world's biggest cryptocurrency, moved lower on the news.

Crypto miners Riot Platforms, Marathon Digital and Hut 8 Mining fell between 1.3% and 5.4% before the bell.

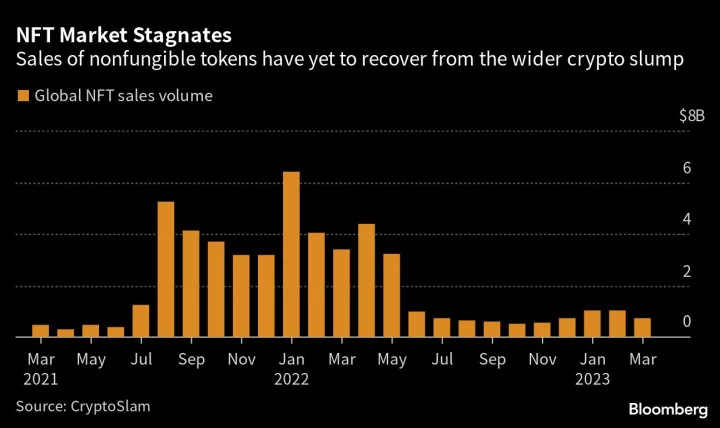

Global regulators have been keeping a close watch on the crypto world after a string of high-profile collapses wiped out more than a trillion dollars from the digital assets industry's market capitalization last year.

Coinbase did not immediately respond to a Reuters request for comment. It had disclosed in March that it received a 'Wells notice' from the SEC threatening a potential lawsuit over certain products.

(Reporting by Manya Saini in Bengaluru; Editing by Shinjini Ganguli)