Asia is fast becoming the new center of gravity for cryptocurrency markets.

As US regulators sued three major crypto exchanges this year, billions of dollars of trading volumes have migrated to Asia. That shift could be poised to accelerate as market makers and exchanges move resources to a region where several jurisdictions have introduced regulatory frameworks and are vying for digital-asset traders.

Investors and marketplaces are flocking to Singapore, Japan and South Korea — and more recently to Hong Kong, which this month introduced a new regulatory regime for crypto. Bitcoin trading activity in predominantly Asian hours have risen this year even as they slumped in US and European hours, data compiled by CryptoQuant show. The token accounts for almost half of crypto’s total market value.

The resilience in Asian crypto volumes is underpinned by institutional investors who perceive the regulatory environment there as less risky, according to several market participants interviewed by Bloomberg.

“With so much regulatory uncertainty in the US, Asia has become an increasingly important hub for digital-asset activity,” said Jonny Caldwell, who focuses on alternative investments including cryptocurrencies as co-head of asset management at Trovio Group. “We are observing a major shift to Asian-based exchanges and venues in the last few months.”

What makes the change even more notable is that it has occurred even as crypto trading remains banned in China, while India levies draconian taxes that have sapped activity there. The two countries together account for more than half of Asia’s population, so they represent a vast opportunity should their policies ease.

“The base for new users in Asia is huge,” said Chuan Jin “CJ” Fong, head of sales for Asia-Pacific and Europe, the Middle East and Africa at crypto market maker GSR Markets. Fong said he expects trading to continue to shift from the US, and to a lesser extent Europe, to Asia.

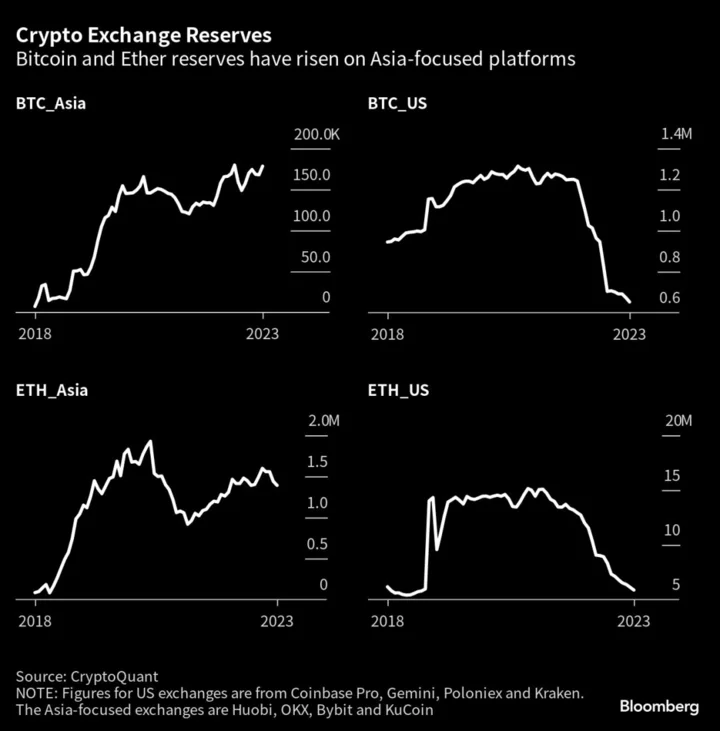

The pivot toward Asia was underway even before the US Securities and Exchange Commission under Chair Gary Gensler launched a wide-reaching clampdown this year. Reserves of Bitcoin and Ether, an indicator of where traders are moving their assets, plunged at US-based exchanges following the collapse of FTX in November.

That trend continued this year as the SEC filed lawsuits against Gemini, Binance, Coinbase and Justin Sun, the entrepreneur who runs Huobi Global. The agency also indicated that it considers at least 19 digital tokens to be securities, meaning they should be under its purview. The SEC’s proposed designation triggered a sharp selloff in those coins.

Read more: Why Crypto Flinches When SEC Calls Coins Securities: QuickTake

While Europe has been making strides in crypto regulation, the EU-wide Markets in Cryptoassets regime won’t come into effect until starting in 2024. The UK, which is formulating its own rules for cryptoassets, this month said it would ban the “refer a friend” bonuses that are popular in the industry as part of stricter regulations around marketing of digital assets.

Binance’s global market has held steady since April even as its share of trading in euro pairs tumbled, according to researcher Kaiko. The company on June 16 said it was quitting the Dutch market after failing to get a registration there. The same day, French authorities said they are investigating Binance.

Binance.US, a separate entity that caters to US traders, has seen its market share almost evaporate following lawsuits from the SEC and the Commodity Futures Trading Commission.

Estimating market share for Asia is difficult because the various crypto hubs use different fiat trading pairs. But “Binance has had a historically strong user base in Asia,” said Clara Medalie, director of research at Kaiko.

The shifting tides have sparked a headlong rush by exchanges and other market participants to expand in Asia, even as they downsize in the US. Since November, Binance has entered Japan and South Korea through acquisitions. Its joint venture in Thailand, Gulf Binance, received local licenses last month and will start operating in the fourth quarter.

Gemini, which has sought to dismiss the lawsuit the SEC filed in January, on Monday said Singapore will be its hub for the Asia-Pacific region and announced plans to boost headcount in the city-state to more than 100 in the next 12 months.

FalconX, a San Mateo-based digital-asset prime broker, plans to expand in Asia and has applied for a license in Singapore, said Matt Long, the firm’s general manager for APAC.

“We see a lot of appetite for crypto over-the-counter derivatives from family offices, proprietary traders and hedge funds in Singapore and Hong Kong,” Long said. “Derivatives will be a main driver for digital assets trading and we expect Asia to lead the growth.”