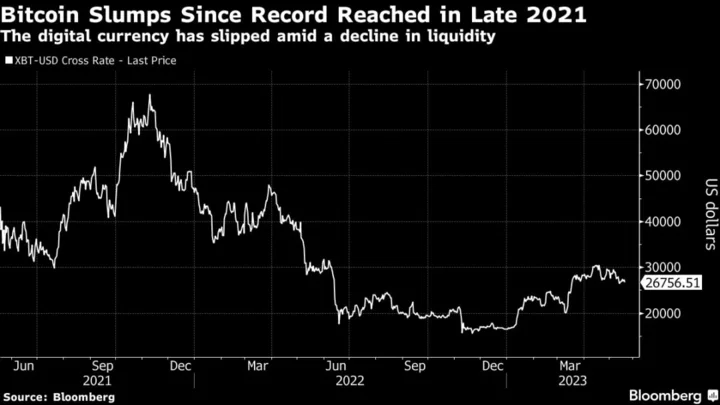

First the crypto lenders imploded, then the industry’s second-largest exchange collapsed. Next to go were the crypto-friendly banks. In the latest blow, major trading firms — the players responsible for the market’s plumbing — are now retrenching.

As Jane Street Group, Jump Trading and other major firms pull back from crypto trading in the US amid heightened regulatory scrutiny, the market is quickly becoming less liquid, less mainstream and less attractive to institutional investors. That’s leaving the new landscape of digital-asset trading looking a lot like the crypto industry of the not-too-distant past: funkier, scrappier, riskier.

“They brought real gravitas and legitimacy to an industry that was kind of on the fringes and made it feel more mainstream, more secure,” said Michael Safai, co-founder of London-based Dexterity Capital, a proprietary high-frequency crypto-trading firm. Among the firms trying to fill the void, “there’s a bunch of other shops out there like us, that are small that you probably have never heard of.”

The pullback of major market makers is likely to sideline big investors over concerns about the greater risk of moving prices through large orders, according to Noelle Acheson, former head of market insights at Genesis Global Trading Inc. and author of the Crypto Is Macro Now newsletter. That can spur “a downward spiral,” she said, with market makers needed before demand is created, but demand needed before market makers are willing to come back in.

“Comparing to a year ago, it’s a very different market now,” Acheson said. “Market maturity is very much influenced by market liquidity, by diversity of offerings, by diversity of service providers — and, on all of those fronts, the crypto market has taken a few steps back.”

Jane Street and Jump’s retreat is already having an impact on liquidity and price stability in crypto markets. Bitcoin trading volume plunged to about $4 billion a day on average last week, compared to $20 billion in March, according to data from Coin Metrics Inc.

The impact can be seen in particular on Binance.US. In early May, Bitcoin prices on the trading platform at one point reached more than $600 higher than the consensus price on other exchanges. Market makers normally profit by arbitraging prices across exchanges, removing price differences on the same asset among different platforms. And Bitcoin liquidity on US exchanges has slumped 50% since the beginning of the year, according to data provider Kaiko.

Since early May, wallets identified as Jump’s have been withdrawing capital without making fresh deposits on Binance.US, according to analytics data from Arkham Intelligence Inc.

“The decrease in market makers, a critical component of vibrant trading activity, has raised concerns about the overall robustness of the market in the short term,” analysts at Coin Metrics wrote.

Binance.US didn’t respond to a request for comment. Representatives for Jump and Jane Street declined to comment.

Read More: Closer Look at Bitcoin Rally Suggests Depth of Demand Deceptive

The moves by the two firms come amid industry turmoil that began almost a year ago. The blowup of the Terra and Luna coins led to the shutdown of hedge fund Three Arrows Capital and crypto lenders Celsius Network LLC and Voyager Digital Ltd. Then came the collapse of Sam Bankman-Fried’s empire, including the FTX exchange and his Alameda Research hedge fund. Within months, Silvergate Capital Corp. and Signature Bank fell apart too, making it harder for crypto firms to open bank accounts and access US dollars.

US regulators, meanwhile, have turned up the heat on the industry through enforcement actions, and market makers want to avoid being ensnared in the heightened scrutiny.

Jane Street and Jump are among the biggest US trading firms, a group of powerful but typically low-profile firms that underpin the equity and options markets. The two companies ventured into crypto in the runup to the industry’s two-year bull market that ended in late 2021. Jump’s digital-assets unit, Jump Crypto, and Jane Street attracted scrutiny as they were among the trading firms looked into by US prosecutors in a probe of the failed TerraUSD stablecoin project. Neither firm was accused of wrongdoing.

Jane Street is scaling back its crypto ambitions globally because regulatory uncertainty has made it difficult for the firm to operate the business in a way that meets internal standards, a person familiar with the matter told Bloomberg News this month, and Jump Crypto is pulling back from the US market for the same reason, two people familiar with the matter have said. Both firms are still making markets, though on a smaller scale, the people said.

Read More: Jane Street, Jump Pull Back Crypto Trading Amid US Crackdown

Jane Street was seen as a liquidity provider of last resort in crypto, offering prices quoted on most major crypto exchanges and by brokers for Bitcoin, Ethereum and even meme coins. It was one of several Wall Street quant firms, along with DRW Holdings, Susquehanna International Group and Hudson River Trading, that marched into the digital-assets industry in the past few years. Some of them bought stakes in crypto startups, made deals with token projects and dabbled in decentralized finance — a crypto Wild West where computer codes execute transactions automatically.

A number of Jane Street alumni went on to crypto-focused firms. Bankman-Fried worked at the company before leaving to start Alameda in 2017.

Institutional lending was also a big source of trading volume, but lending has dropped off following the bankruptcies of Celsius Network, BlockFi and Genesis Global Capital.

“The market has lost a lot of over-the-counter liquidity providers in the past year, and a lot of that liquidity was provided by people operating through leverage,” said Chris Zuehlke, a partner at DRW and global head of Cumberland DRW, the digital-assets unit of Chicago-based trading house founded by Don Wilson.

No Layoffs

Cumberland is among the firms stepping up as some other big players retreat. Another is Wintermute Trading Ltd., which has increased its headcount to more than 80 employees, up 30% from a year ago. The London-based crypto market maker is expanding its business to trade more traditional instruments related to crypto, such as exchange-traded products and futures listed on the Chicago Mercantile Exchange and Eurex, as well as over-the-counter trading.

“We are one of the very few companies out there that didn’t scale down magnificently and didn’t do any layoffs,” Wintermute Chief Executive Officer Evgeny Gaevoy said in an interview.

Galaxy Digital Holdings Ltd., the crypto financial-services firm founded by Michael Novogratz, is also positioning itself to take advantage as others pull back.

“Coming out of 2022, there’s a lot of shifting sand broadly in crypto — you saw some of the largest players historically in the space either blew up or are significantly impaired,” said Jason Urban, global head of trading at Galaxy. “We were the beneficiary of that.”

The company recently built a trading team in Hong Kong to capture offshore growth. Indeed, with the pullback of bigger players and heightened regulatory scrutiny in the US, the crypto industry is poised to be dominated by smaller firms and much of the activity is likely to happen overseas, in countries such as South Korea, Australia and Switzerland, said Safai of Dexterity Capital, one of the beneficiaries of the retrenchment by Jane Street and Jump.

“We are able to step in and provide some of that liquidity and fill some of these gaps that have been left behind,” Safai said. “But I don’t have Jump’s balance sheet, Jane Street’s balance sheet, and missing that liquidity in the market is bad for pricing and it’s bad for everybody. We hope somebody will step up and fill the gap.”