Cryptocurrency trading volume declined in August to the lowest level of the year, another sign of waning investor interest since the collapse of digital asset prices from all-time highs in late 2021.

The combined monthly volume of so-called spot and derivatives trading fell 11.5% to $2.09 trillion, and was the second-lowest monthly total since October 2020, according to data compiled by CCData.

“The (spot) trading volumes on centralized exchanges have remained low since April this year and are now comparable to the stagnant trading activity in the bear market of 2019,” CCData said in a report published Thursday.

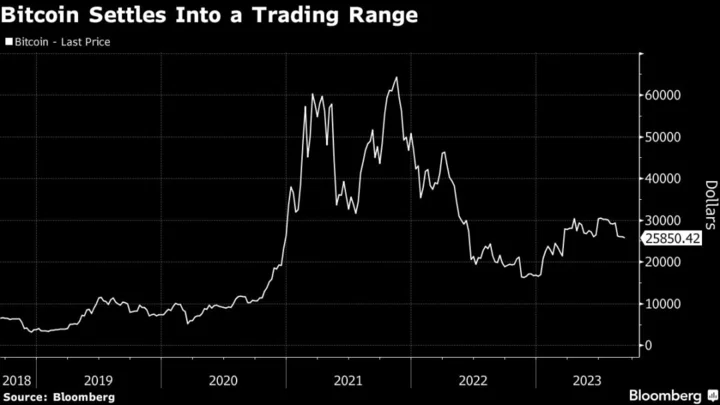

The tepid interest appears to be carrying into September, with crypto bellwether Bitcoin little changed through much of the first week of the month. Bitcoin, which accounts for about half of crypto’s $1 trillion market capitalization, was little changed at around $25,800 on Thursday. It almost reached $69,000 in November 2021.

Derivatives trading volume on centralized exchanges fell 12.3% to $1.62 trillion, the second lowest amount since December 2020, according to CCData.

Spot trading volume on centralized exchanges fell for the second consecutive month, dropping 7.78% to $475 billion, according to CCData, marking the lowest monthly spot-trading volume recorded since March 2019. Daily volumes on centralized exchanges reached $5.9 billion on Aug. 26, the lowest since Feb. 7, 2019.

While Binance remains the largest exchange for crypto spot trading, its market share shrank for the sixth straight month, settling at 38.5%, the lowest since August 2022, according to CCData.