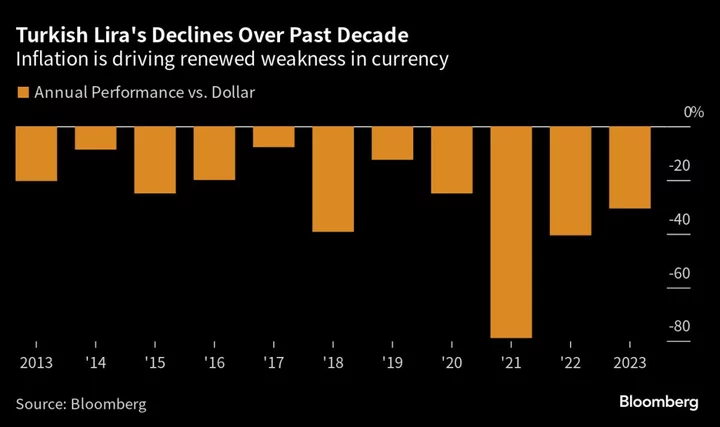

Turkey’s rebounding inflation is prompting bank economists to issue more pessimistic forecasts for the lira, already one of the worst performing emerging-market currencies this year.

Deutsche Bank AG on Friday revised its year-end forecast to 32 per dollar from its current trading level of about 27, a day after inflation data surpassed expectations. Annual consumer-price increases accelerated to 48% last month from 38% in June, heading higher again after slowing for the previous eight months.

The Turkish central bank, under new Governor Hafize Gaye Erkan, recently acknowledged price pressures and significantly revised up its inflation forecast to 58% by year-end, peaking at 60% in the second quarter of 2024. But it said it will stick to a tightening cycle it describes as “gradual,” leaving real rates well below zero.

Deutsche Bank analysts cited the trajectory of price increases and the “challenges confronting policymakers in returning inflation to a more sustainable path” for its revisions. It also said it sees the lira sliding further to 35 per dollar at the end of 2024.

The Turkish currency came under renewed pressure after elections in May, won by incumbent President Recep Tayyip Erdogan, as a new market-friendly team began to slowly ease the authorities’ grip over the currency. The lira has dropped about 30% against the greenback this year, making it the worst-performing emerging-market currency after the Argentine peso. It was trading at about 26.99 per dollar as of 3.40 p.m. in Istanbul.

HSBC also on Friday revised its lira forecast to 29 per dollar, compared with 27 previously. Bank strategists Murat Toprak and Charlotte Ong said in a note to clients that they see it weakening further to 32 per dollar in 2024 “on expectations of high inflation.” They said a widening of the trade deficit may also pose a risk to the currency.

“This is all the more concerning from an FX perspective, since the support coming from strong tourism income tends to fade from November,” they said.

The central bank’s benchmark rate currently stands at 17.5%, and both Deutsche Bank and Morgan Stanley expect a 150 bps rate hike at this month’s policy meeting.