Investors are betting that Sri Lanka’s local debt and equities will see a significant upside, when markets reopen Tuesday post a three-day holiday, after a plan to revamp domestic debt eased concern over financial sector stability.

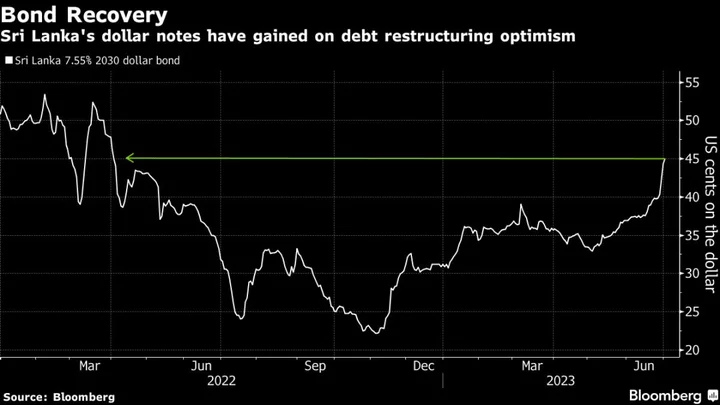

The island nation mostly spared local commercial banks in its blueprint unveiled last week to protect the economy while striking a balance between domestic creditors and foreign bondholders. The plan —- aimed at helping restore debt sustainability in line with a $3 billion International Monetary Fund bailout —- sent dollar bonds surging 12%, marking their best week since November.

“The domestic debt optimization plan being limited to the central bank and superannuation funds is very positive for the economy,” said Dimantha Mathew, chief research and strategy officer, at First Capital Holdings in Colombo. “There may now be interest from foreign investors for rupee bonds.”

A surge in Sri Lankan stocks is also the most likely outcome after policymakers chose to only restructure Treasury bills held by the central bank and treasury bonds of pension funds, according to analysts at Colombo-based Asia Securities Research, who project a 34% gain in the benchmark index this year.

Sri Lanka’s government started its domestic bond swap program on Tuesday, inviting investors to submit offers to exchange existing notes for new ones.

Neighboring Pakistan’s key stock gauge surged the most in over 15 years on Monday after the nation clinched an IMF bailout. The local currency advanced in the black market as well.

Financial support from multilateral lenders has boosted investor confidence — and returns — across troubled emerging and frontier markets in recent months. Funds getting approved or disbursed for countries including Kenya, Tanzania, and Pakistan are giving hope that the embattled economies are turning a corner and international capital will soon start flowing in.

More Upside

“The equity market in Sri Lanka has more room to run,” said Ruchir Desai, fund manager at Asia Frontier Capital, who is increasing his fund’s allocation to Sri Lanka “I am much more optimistic on the outlook compared to the past few years.”

The details of Sri Lanka’s debt restructuring with foreign bondholders and bilateral creditors still need to be hammered out. That’s why Mark Baker, head of fixed income at abrdn plc in Hong Kong, prefers to stay invested in T-bills, which are outside the scope of the restructuring and carry yields of about 17% to 22%.

While import restrictions are likely to be gradually removed, Baker expects the Sri Lankan rupee to be relatively stable, after clocking a 20% appreciation against the dollar so far this year, making it the world’s best performer.

--With assistance from Selcuk Gokoluk, Asantha Sirimanne and Anusha Ondaatjie.