Billionaire Patrick Drahi declared to investors that reducing Altice France’s leverage was his “single priority” in a bid to assuage concern over the telecommunications business’s debt pile of almost $30 billion.

In a call with investors Tuesday, Drahi outlined options including selling assets, contributing shareholder equity and buying back some of the bonds at a discount. Altice France committed to reduce its debt by one turn of leverage within the next 12 months.

“My single priority today for Altice France today is to de-lever and strengthen the capital structure,” said Drahi, whose comments were accompanied by a presentation saying the firm would do “whatever it takes” to reduce debt.

Drahi spoke to bond investors in his group of companies on Monday and Tuesday, seeking to reassure them on the deleveraging plans and provide an update on the impact of a Portuguese corruption probe. The investigation has embroiled key personnel across the network of companies, prompting a precipitous decline in the bonds.

Altice France also confirmed that the company was still in active discussions on the sale of a data center, a process that has been closely watched by investors. Management said the sale, which they had expected to wrap up during the summer, has been delayed due to the probe.

Altice France subordinated bonds due in 2027 gained 0.5 cent following the presentation to investors, erasing losses from earlier in the day in the wake of the company reporting a decline in second-quarter earnings. The French business operates telecom company SFR and owns media operations including cable news channel BFMTV and radio station RMC.

Read more: Drahi Says Corruption Probe Had ‘No Impact Whatsoever’ on Altice

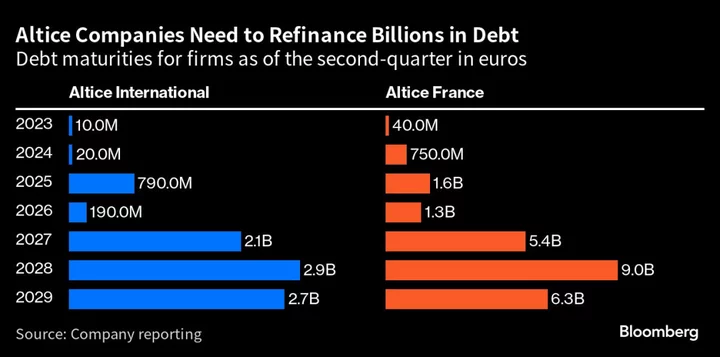

Executives said that the options for deleveraging Altice France were being considered in parallel, and what will happen next is still fluid. Altice France has already looked to improve its debt sustainability, and this year extended the maturity of its term loans.

In a call with investors Monday for Altice International, Drahi gave his personal support for the debt, saying he still owned some of Altice France’s unsecured bonds as part of his personal holdings. Such bonds have been trading at a steep discount, with some unsecured notes trading at below 50% of face value, according to data compiled by Bloomberg.

Altice International, which operates in Portugal, Israel and the Dominican Republic, also pledged to reduce its borrowings in the next year. The company plans to come to market in the second half of the year to address its 2025 and possibly 2026 maturities, which would be in part funded by an upcoming sale of a data center in Portugal.