Uncertainty over the end point for the European Central Bank’s unprecedented bout of interest-rate hiking will hang over the region as warnings about its worsening economic prospects grow louder.

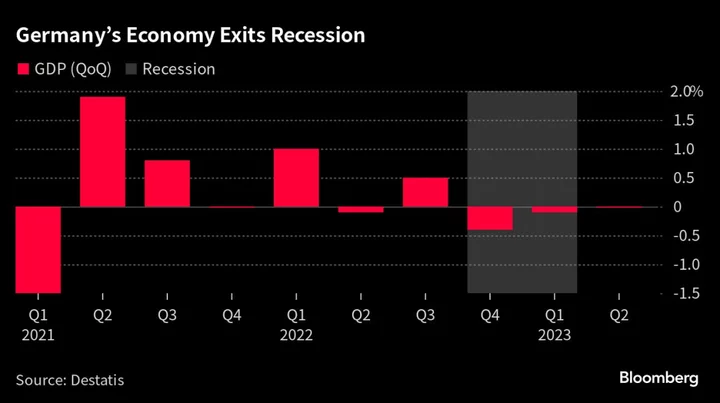

While data released Friday suggested the 20-nation euro zone managed to grow in the second quarter — with Germany, it’s biggest member, just about exiting a recession — the outlook has soured notably of late.

Inflation, meanwhile, is set to remain well above the 2% target over the summer, leaving policymakers in Frankfurt in no shape to declare victory after a yearlong campaign that’s included nine rate increases.

The upshot is that the ECB’s next meeting in September may well be just another stop on the journey to peak rates. Markets expect one more move but don’t exclude that hike arriving as late as December. For a region whose short-term outlook has already deteriorated, according to President Christine Lagarde, that’s a big question mark.

“Even if we were to take a break in September, it would be premature to consider it automatically the end of the cycle,” Governing Council member Peter Kazimir said Friday, urging another “firm step” toward a peak he described as “within reach.”

Kazimir spoke after figures out of France provided some cheer: Second-quarter gross domestic product unexpectedly jumped by 0.5% from the previous three months and inflation abated in July. Spain, too, saw robust output of 0.4%, though that marked a slowdown and consumer-price gains wrong-footed analysts by quickening.

Germany remained the main weak spot. GDP there was unchanged between April and June following two quarters of contraction. Inflation eased somewhat this month but at 6.5% is more than three times the goal. Some are talking of stagflation.

The euro area as a whole reports its second-quarter growth reading on Monday, with economists estimating an expansion of 0.2%. But doubts are arising over how long it can keep its head above water.

Confidence in the region has deteriorated sharply in recent weeks and sentiment surveys signal it will only get worse from here as higher rates continue to filter through to the economy. Services, long a stronghold for growth amid a protracted manufacturing malaise, have begun to weaken. The ECB has even sounded the alarm on the so-far sturdy labor market.

For some officials, the signs are enough to call time on hikes.

“If there’s one more — and I hardly see the case for it — in September, I think we will stop there,” Greek central bank chief Yannis Stournaras said Friday.

His French counterpart, Francois Villeroy de Galhau, wasn’t quite so explicit but did echo Lagarde in saying that future rate announcements aren’t pre-determined.

“Decisions at coming meetings will from now on be open and be entirely guided by economic data to come,” he said.

Wage negotiations across the currency bloc will be key. To take just two examples, talks covering employees in retail, wholesale and foreign trade in Germany are scheduled to last at least through September, while in Ireland, the government is only set to decide in the autumn by how much the minimum wage will rise in 2024.

With such processes very much still up in the air, the path ahead may not be as obvious as many had been assuming.

“Perhaps there will be a pause in September,” Lithuanian central bank head Gediminas Simkus told reporters in Vilnius. “But we may need to hike again in October.”

--With assistance from Milda Seputyte, William Horobin, Daniel Hornak and Paul Tugwell.

(Updates with German inflation in seventh paragraph.)