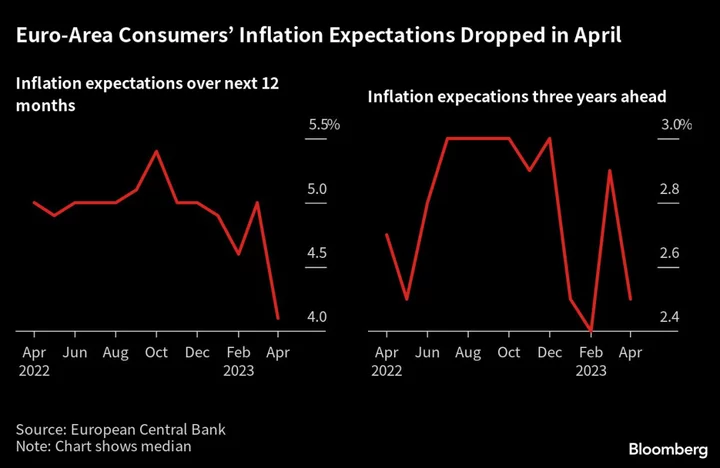

Consumer expectations for euro-zone inflation eased significantly in April, adding to the case for the European Central Bank’s historic ramp-up in interest rates to conclude this summer.

Expectations for the next 12 months fell to 4.1% from 5% in March, the ECB said Tuesday in its monthly survey. For three years ahead, they slid to 2.5% from 2.9% — moving toward the 2% medium-term target.

The poll’s recent results show the choppy nature of the retreat in inflation, which hit a euro-era record last year. March’s survey revealed a “significant” upswing in price expectations.

Indicators since then have proved more encouraging. Inflation itself slowed to 6.1% in May, and an underlying measure stripping out volatile elements such as energy weakened more than expected to 5.3%. The European Commission’s survey of inflation expectations for the coming year fell to the lowest since 2020.

With the ECB expected to raise interest rates next week, the survey will feed into the debate about how long borrowing costs must rise to ensure inflation returns to target. Governing Council member Boris Vujcic told Bloomberg this week that price risks remain skewed to the upside.

Investors and most economists anticipate two more quarter-point increases in the deposit rate, to a peak of 3.75%.

ECB President Christine Lagarde reiterated Monday that rates will rise further to regain control of prices, saying there’s “no clear evidence” that underlying inflation has peaked.

Still, Klaas Knot — who heads the Dutch central bank and is among the more hawkish ECB Governing Council members — warned earlier on Tuesday that the euro area is now observing second-round effects from higher energy costs, meaning that it will be harder to bring down consumer prices.

In its survey, the ECB also said:

- Uncertainty about inflation expectations 12 months ahead decreased

- Nominal income expected to rise 1.1% over the next 12 months, down from 1.3%

- Expectations for economic output for the next 12 months improved to -0.8% from -1%

- Unemployment rate seen at 11.2% in 12 months, down from 11.7%