Sluggish growth in the euro-zone economy is threatening to amplify risks to financial stability posed by higher interest rates, the European Central Bank warned.

As the impact of the ECB’s historic monetary-tightening campaign continues to unfold, household incomes, corporate revenues and public finances could feel an additional squeeze if the economy continues to disappoint, the central bank cautioned in its bi-annual Financial Stability Review.

“The weak economic outlook along with the consequences of high inflation are straining the ability of people, firms and governments to service their debt,” ECB Vice President Luis de Guindos said in a statement. “It is critical that we remain vigilant as the economy transitions to an environment of higher interest rates coupled with growing uncertainties and geopolitical tensions.”

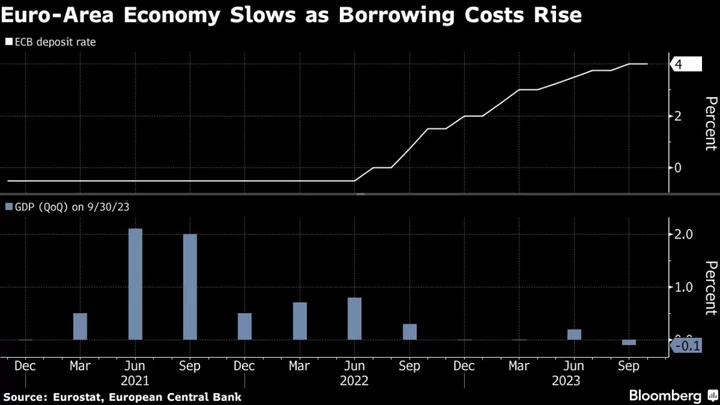

The outlook for the 20-nation euro area has worsened of late and a recession is possible after output shrank 0.1% in the third quarter. Activity is only expected to pick up slightly next year, while downside risks such as the uncertain impact of rate hikes and geopolitics were seen dominating when policymakers met in October.

Still, financial markets currently expect a “soft landing,” where inflation moderates without a significant hit to growth, according to the report. Historical evidence suggests such a scenario is “difficult — although not impossible — to achieve in practice, especially given the magnitude of rate increases in a short period of time,” it said, adding that negative surprises to growth risk a “disorderly correction.”

The ECB has raised rates 10 times since mid-2022, but left them on hold last month. While the effect of that campaign is increasingly being felt in sectors such as real estate, much of the tightening has yet to filter through as borrowing costs for households, companies and governments only gradually shift higher.

Corporate insolvencies, though, are starting to pick up and could rise further as the economic downturn becomes more broad-based and credit costs rise, the ECB said.

“There could be more defaults going forward, with potential knock-on effects on bank balance sheets, non-bank investors in corporate debt and household employment prospects,” it said.

Officials also warned that the environment is getting rougher for banks, which have so far benefited from rising rates. Lenders now face higher risk provisions as more borrowers struggle to repay loans.

Banks’ funding costs are also set to rise as competition for deposits heats up, more customers shift their cash into higher-yielding term deposits and maturing liabilities need to be refinanced.

Sovereign Debt

To limit risks, the ECB urged authorities to preserve the so-called macroprudential capital buffers that can be drawn on if conditions in the sector worsen. Current bank-profitability levels could even allow an increase in some countries, it said.

Turning to budgetary matters, the ECB warned that “risks of fiscal slippage” could re-emerge, despite Italy’s credit rating — the top focus of investor concern — being pulled back from the brink of junk by Moody’s Investors Service.

It said European Union negotiations over new fiscal rules “are inducing significant uncertainty,” and that reaching a deal “is critical in order to anchor expectations for debt sustainability and sustainable, inclusive growth.”

--With assistance from Nicholas Comfort.