Any additional interest-rate increases by the European Central Bank won’t be big, according to Governing Council member Martins Kazaks, who’s undecided on what’s needed when officials meet next month.

Kazaks said that while inflation is slowing across the euro zone, he must see the ECB’s new quarterly projections and inflation data for August before settling on a course of action.

“On interest rates, the big rise is behind us,” he told Latvia’s TV3 on Thursday. “If we look at the coming months, if there’ll be increases in interest rates then they’ll be really very small.”

The remarks from one of the ECB’s top hawks come before a September rate meeting where officials will decide between pausing or prolonging their unprecedented hiking campaign.

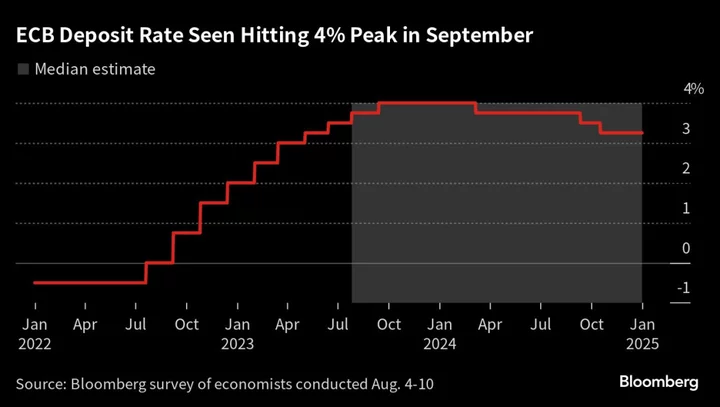

Analysts polled by Bloomberg see one final quarter-point increase in the deposit rate, to 4%, even as inflation pressures abate and the region’s economic prospects worsen. While the euro area has so far avoided a recession, its biggest member — Germany — stagnated following a winter downturn.

Kazaks, whose homeland of Latvia has seen inflation sink to 6.4% from a peak of 22% last year, called the moderation in price gains “good news.”

“The increase in inflation was really very strong, it was very high,” he said. “It hit every household in Latvia.”