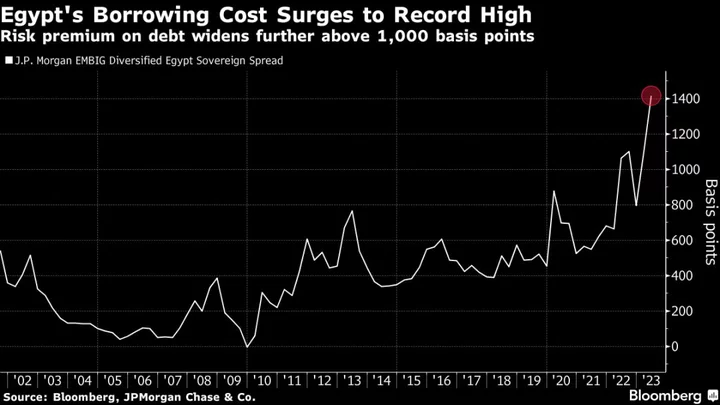

Egypt’s dollar bonds sank deeper into distress after Moody’s Investors Service placed the North African nation’s ratings on review for downgrade.

The appraisal “reflects the sovereign’s increasing liquidity and debt affordability risks,” Moody’s said in a statement late Tuesday. In February, the credit assessor had cut the nation’s score to B3, the lowest assigned by the three major rating companies.

Several of Egypt’s bonds slumped to record lows on Wednesday. The note due 2051 fell 0.7 cent to 49.8 cents on the dollar, while the security maturing in 2061 slid 0.5 cent to 47.7 as of 10:49 a.m. in London.

Egypt’s government has struggled to regain access to external financing as it grapples with the economic fallout of Russia’s invasion of Ukraine and higher US interest rates.

The International Monetary Fund is waiting to see Egypt enact more of the wide-ranging reforms it pledged — including genuine flexibility in the currency and privatization deals for state assets — before carrying out the first review of a $3 billion rescue program. Billions of dollars in promised funding from Gulf Arab nations have yet to materialize.

“Slower-than-anticipated progress with the state-owned asset sale strategy, a key component of the 46-month IMF program that started in December 2022, risks undermining Egypt’s financing plans, weakening the sovereign’s foreign exchange liquidity and eroding confidence in the currency,” Moody’s said.

‘Pressures and Challenges’

Egyptian Finance Minister Mohamed Maait said in a statement Tuesday that the nation is “committed to achieve the financial targets during the current fiscal year, despite the severe global pressures and challenges facing the Egyptian economy.”

Inflation in urban parts of Egypt eased for the first time since June 2022, providing a reprieve that may prove temporary for an economy struggling to stabilize its exchange rate. Consumer prices rose an annual 30.6% in April, down from 32.7% the previous month, thanks in large part to a favorable base effect.

The government targets a primary surplus of 1.5% of gross domestic product in the current fiscal year and 2.5% in the next, according to Maait’s statement. The target is to reduce the debt-to-GDP ratio to less than 80% by 2026-2027, compared with a projection of above 90% this year.

“The economy is standing on its feet in the face of external shocks, and Egypt will overcome these global challenges as it did many crises before, particularly as we have a diversity of income sources and we are able to attract foreign direct investment,” said Maait.

Path Ahead

“The measures taken by the government and the reforms it implements to empower the local and foreign private sector will contribute to the speedy return of the Egyptian economy to strong and sustainable growth,” he said.

Still, the government targets a 6.5% budget deficit by the end of June, increasing to 6.69% the next fiscal year. That’s “a result of the rise in interest rates in the domestic and international markets and the increase in spending on social protection and meeting basic needs in light of the unprecedented rise in international prices for commodities, grains, food and fuel,” Maait said.

A one-notch downgrade would bring Egypt’s rating at Moody’s to Caa1, seven levels below investment grade and the lowest since 2013-2015, a period when political turmoil stalled a previous IMF loan.

Moody’s said the review period will focus on the government’s ability to finalize the targeted $2 billion in asset sales necessary to meet the IMF program’s financing targets for the fiscal year ending in June and demonstrate the viability of the program’s external funding strategy, which relies significantly on asset sales.

It will also focus on authorities’ ability to bolster net international reserves and support confidence in the currency, the credit assessor said.