A gauge of developing nation currencies dropped for the first time this week as a hawkish tweak to Japanese central bank policy threatened to cool this year’s most lucrative emerging-markets strategy.

The surprise loosening by the Bank of Japan of its grip on bond yields Friday holds particular significance for emerging-market currencies as Japanese investors are at the center of the carry trade — borrowing in countries with low interest rates to invest in higher-yielding assets. Yen-funded carry trade strategies have outperformed those borrowed in dollar in all developing markets this year, based on data compiled by Bloomberg.

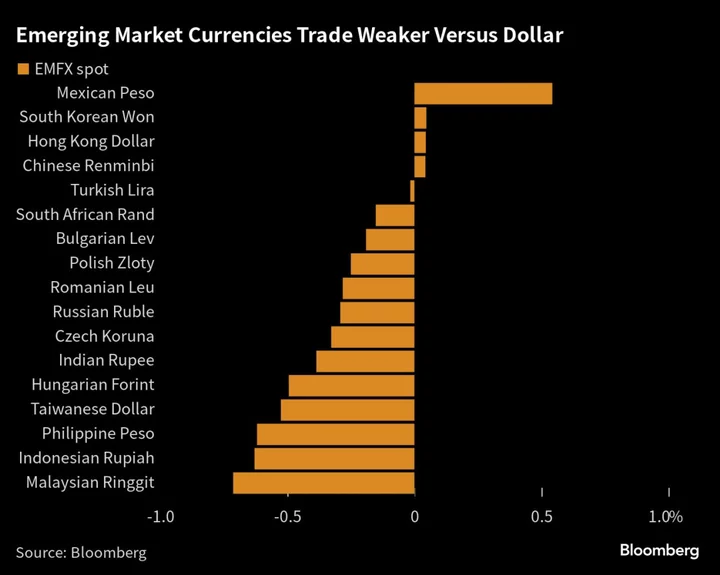

MSCI’s EM currency index fell as much as 0.4%, with Asian currencies leading the declines.

The pressure on emerging-market currencies reflects “fears that to the extent JPY has been used as a funding currency to go long carry, higher Japanese yields and a stronger JPY would make those carry trades less attractive,” said Henrik Gullberg, macro strategist at Coex Partners.

“Having said that, BoJ has not committed to further tightening, and carry in a number of EMs remain attractive,” he said.

Twenty four of 26 domestic benchmark bonds monitored by Bloomberg were flat or lower. Yields on South Korea’s bonds due 2033 climbed 10 basis points to 3.76% the highest since March. Yields on South Africa’s rand-debt due 2035 rose as much as 11 basis points, the most in two weeks.

Carry has been a major contributer to the relative total return performance of emerging markets this year, according to Teresa Alves at Goldman Sachs Group Inc. The Mexican peso, South Africa’s rand, the Polish zloty and the Turkish lira are among the most popular emerging-market currency trades with Japanese retail investors, who dominate Tokyo’s foreign-exchange market.

Read more: Japan Mom-and-Pop Traders Lift Emerging-Market Currency Bets

The MSCI emerging-market currency index was 0.1% lower by 1:34 p.m. in London, still poised for a 0.4% gain for the week.

“It goes without saying that the rise in the lowest risk-free rate globally will definitely inflict further pressure on EM carry trades, especially at a time when rate cuts are viewed within the EM space,” said Simon Harvey, the London based head of FX analysis at Monex Europe Ltd.

In the near term, the greater threat for emerging-market currencies would likely be resilient US growth data and increasing risks that the Federal Reserve needs to extend its hiking cycle into the fourth quarter.

Friday’s June US real personal spending data is key in this regard, ahead of next week’s payrolls and productivity numbers, Harvey said.