Investors are growing more confident that a year-long slump in profits for Corporate America is about to end. Yet a fragile economic outlook, wary consumers and the highest interest rates in 16 years mean any relief for stocks could be short-lived.

Analysts predict the companies in the S&P 500 will report a 1.2% drop in third-quarter earnings — the fourth straight decline — before a 6.5% rebound in the final three months of the year, according to estimates compiled by Bloomberg Intelligence.

Unusually, estimates have risen going into the reporting season, a sign of confidence that has lifted the S&P 500 by 0.9% in October after back-to-back monthly drops. If companies surpass those predictions, as they usually do, third-quarter earnings may even increase.

“A slightly better outlook for S&P 500 earnings should finally emerge in the third quarter, but the recovery is still fragile and lacks breadth,” said Gina Martin Adams, chief equity strategist at Bloomberg Intelligence. While the momentum of estimate revisions has picked up, margins outside the energy sector “need to firm” and the outlook for sectors sensitive to the economic cycle needs to improve “for stocks to derive confidence,” she said.

That confidence may be hard to come by. Shoppers and companies alike are feeling the pinch from higher interest rates, while the economy in China — long an engine of growth for the world — is struggling to get in gear. Even luxury goods-makers such as LVMH are warning of slowing demand after holding up under high inflation. And the conflict between Israel and Hamas has the potential to disrupt the world economy.

Here’s a look at some themes investors will be focused on as they parse earnings reports.

Consumer Spending

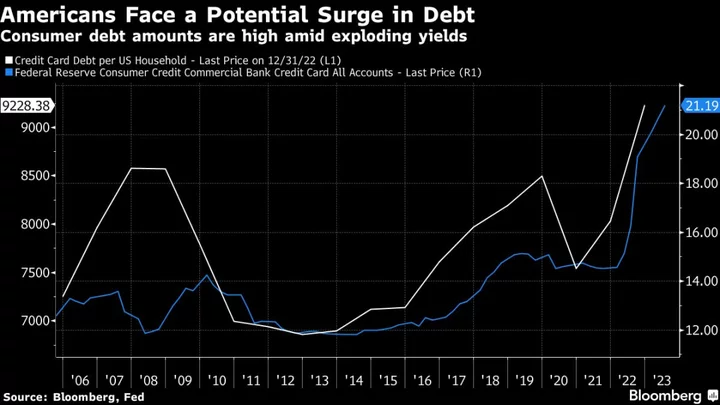

A key determinant of whether the earnings recovery can last is the US consumer. Spending is likely to take a hit as Covid-era savings are depleted and payments resume on federal student loans. The surge in interest rates means credit card debt could double in the next three to four years, according to data from the Federal Reserve.

Consumer spending rose just 0.1% in August after adjusting for inflation, the weakest since March.

The risk is higher for retailers that cater to low-to-middle-income consumers as they’re more sensitive to any rise in inflation. Denim brand Levi Strauss & Co. last week cut its full-year sales outlook, citing a squeeze on shoppers, while auto retailer CarMax Inc. tumbled as analysts voiced concerns about consumers’ ability to afford cars. But even sales of high-end goods are losing steam, as LVMH showed this week.

Still, there are some bright spots. Fast Retailing Co., the Japanese owner of clothing retailer Uniqlo, issued an upbeat forecast on the back of robust sales in both its home and overseas markets, while Nike Inc. shares jumped on strong demand.

Interest Rates

The most aggressive policy tightening by the Federal Reserve since the 1980s has left Corporate America facing much higher costs of debt.

Interest costs could climb by more than $80 billion cumulatively by the end of 2026 for issuers of dollar-denominated debt with fixed-rate exposure, according to Bloomberg Intelligence. Borrowers in the financial sector account for almost half of the total, while Apple Inc., AbbVie Inc. and Boeing Co. face more than half a billion dollars each in higher interest expenses, BI strategist Noel Hebert wrote in a note.

With latest data showing both producer and consumer prices remain elevated, investors have trimmed wagers of a dovish tilt in Fed policy. That’s likely to add pressure on profit margins just months after analysts’ projections began to improve. At the same time, some industries are facing strikes from workers seeking higher pay, further adding to corporate costs.

“It takes a while for the impact of inflation and interest rates to come through,” said Murdo MacLean, client investment manager at Walter Scott & Partners Ltd. in Edinburgh. “And it’s still coming through and it will still come through next year and the year after. We expect consumers to be tightening their belts, no question.”

Resilient Estimates

One bright spot is that analysts have been more confident about profit growth. S&P 500 earnings-per-share estimates for the third quarter were revised up 0.1% in the past three months, compared with a typical cut of 4%, according to Bank of America Corp. That’s the first time since the fourth quarter of 2021 that forecasts weren’t reduced ahead of the reporting period, the data showed.

As broader US economic growth remains resilient, some market forecasters are counting on companies to beat those estimates at a higher-than-average pace. BofA strategists Ohsung Kwon and Savita Subramanian said they expect a “sizeable” 4% beat rate compared with a typical rate of 2% as inventories fall and earnings outpace growth in gross domestic product.

That’s at odds with findings of a recent Bloomberg Markets Live Pulse survey, which found respondents were bracing for a slew of profit warnings this season due to the impact of higher yields. Reports from companies have been mixed. While PepsiCo Inc. raised its 2023 earnings forecast as consumers absorbed higher prices, Delta Air Lines Inc. cut the high end of its outlook, partly due to higher fuel prices.

Weight-Loss Drugs

While artificial intelligence set markets atwitter earlier in 2023, now weight-loss drugs such as Ozempic and Wegovy are all the rage. Sales of the appetite-suppressing medications — known as GLP-1s — have skyrocketed and upended the market for everything from snacks to booze and medical devices. Novo Nordisk A/S, the maker of the treatments, on Friday raised its outlook for revenue and profit once again.

While some companies such Pringles maker Kellanova have said it’s too early to assess the effect of the drugs on consumer behavior, Walmart Inc. said it’s already seeing an impact on shopping demand. Third-quarter earnings will provide some clues as to whether an index of food stocks, already down 26% from a May high, has farther to fall.

“We believe that the impact will be gradual and the stock selloff in many packaged food companies is way overdone, with any actual slow-down in consumption coming over the next 3-5 years,” said Jay Hatfield, chief executive officer at Infrastructure Capital Management.

China Impact

Another theme this season will be the impact of a choppy economic recovery in China. Signals from the monthly data for industrial profits, manufacturing activity and tourism revenue have been encouraging, but bank margins will likely come under pressure as the country cuts interest rates.

“Industrials and materials earnings will be impacted by producer price deflation and in general weak demand,” said Marvin Chen, a strategist at Bloomberg Intelligence. “We expect the trend to be similar to 2Q. Tech earnings may do fairly well, driven by cost-cutting measures.”

Few market participants expect big positive surprises from the property sector as developers struggle with tepid demand and try to cut debt levels. Suppliers to Huawei Technologies Co. could be a bright spot after the launch of its Mate 60 Pro smart-phone in August, which is expected to boost orders even into next year.

Among international markets, Europe is more exposed to China than the US is, given that its miners, luxury goods-makers and automakers rely on the Asian nation for a chunk of their revenue.

--With assistance from Ishika Mookerjee, April Ma, Jan-Patrick Barnert and Julien Ponthus.