A renewables developer is picking a fight with Chile’s biggest energy group in a case that illustrates the challenges the green power industry faces in emerging markets.

Golden Sun SpA, a power developer based in Santiago controlled by businessman Felix Jaramillo, is suing Enel Green Power Chile in the nation’s antitrust court. A ruling is expected as soon as the first quarter of 2024.

The lawsuit filed in January accuses EGP, a unit of Enel Chile SA, of stealing confidential information, feigning interest in a partnership and forcing Golden Sun out of a solar power project. It claims that EGP, having secured rights for the project, now plans to shelve it indefinitely to distort supply and book profits from higher prices.

Enel Chile declined to comment on the case. Golden Sun’s suit, however, will be closely watched in Chile as the country seeks to further build up its renewables capacity. It could also have an impact on inflation.

Chile’s government has kept wholesale power tariffs frozen since 2019, first to quell social unrest and after that to counter the economic effects of the pandemic. Power bills should rise next year and legislators are studying ways to avoid a drastic jump in consumer prices.

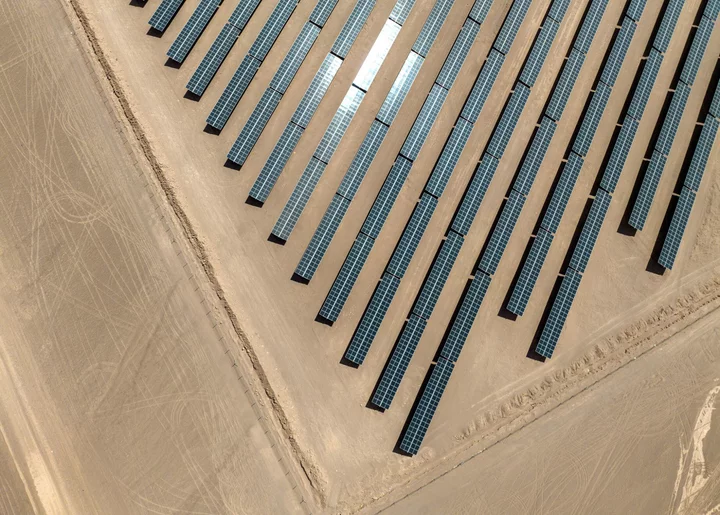

Golden Sun’s spat with EGP dates to 2019 as well. That year Golden Sun secured engineering and environmental impact studies for a project at Llanos de Chulo, a barren desert area about 800 kilometers (497 miles) north of the capital in the Atacama Desert. The plan was to build a 250-megawatt solar project on 520 hectares (1,285 acres) of state-owned land.

Since Jaramillo and his partners didn’t have the experience to develop it on their own, Golden Sun approached EGP to discuss a potential sale of the project or joint venture. It hinged on having Enel’s backing to secure a key license, called a concesión de uso oneroso, from the Chilean government to develop the project as it was located on public land.

However, Golden Sun claims that after initial talks and signing non-disclosure and exclusivity agreements, Enel “feigned interest” and knowingly stalled talks for a potential acquisition, according to a copy of the lawsuit posted on the website of Chile’s antitrust court. The day after the deadline to apply for the concession passed, Jaramillo and his partners learned that Enel had secured it on its own.

Golden Sun claims that Enel stole information from it for their own bid. The non-disclosure agreement between the companies stipulated that if they failed to reach an agreement, Enel would provide proof that it destroyed copies of the confidential information but Golden Sun alleges it has failed to do so.

In its complaint, Golden Sun also says that Enel did this to freeze development of the project as a way to control wholesale power prices in Chile. Enel has answered that it’s still within legal timeframe to develop the project.

“We have reports that would indicate that there is an interest in entering into these bidding processes and delaying the execution of the projects to affect final energy prices,” said Rodolfo Fuenzalida, a partner at law firm Gamboa, Fuenzalida, Sanfeliú & Ugarte, which represents Golden Sun. “And that was a clear economic benefit for Enel Green Power.”

Enel’s lawyers disagree. Golden Sun “is trying to paint a botched negotiation as an attack on free competition,” its lawyers, José Miguel Gana, Rubén Urrutia and Victoria Godoy of firm Gana & Urrutia Abogados, wrote in a document on the court’s website.

Chile has one of the most developed renewable energy markets in South America. Solar is now the country’s largest power generation technology by capacity, according to BloombergNEF. Wind and solar together represent one third and provided 28% of total generation in 2022 — head and shoulders above peers Argentina, Brazil, and Mexico, where the average is 13%.

Still, that doesn’t mean that all renewable energy companies are making money. A transmission shortfall has led to some solar and wind companies having to buy other types of power — such as diesel — from third parties at higher prices to meet their supply contracts.

That’s led several renewables companies to declare bankruptcy. Latin America Power, a wind power generator, is in talks to restructure its debt with creditors while two local units of Ireland’s Mainstream Renewable Power Ltd. filed for protection from creditors. And Acciona SA of Spain is among the many power generators that are clamoring for a reform to the country’s tariff system.

Jaramillo, meanwhile, said he’s lost a lot of money as a result of Golden Sun’s falling-out with Enel. His company has spent almost 500 million pesos (about $600,000) in feasibility studies and other legal expenses.

“Our lawsuit seeks to ensure that Enel Green Power’s actions are sanctioned and that what happened to us does not happen again to any competitor,” Jaramillo said in an interview.