European natural gas prices eased, with traders weighing ever-rising fuel stockpiles against the risk of supply constraints.

Benchmark futures fell as much as 3.2%, following a jump in the previous session. Sluggish demand after last year’s energy crisis and ample inventories for the upcoming heating season are helping to keep a lid on prices.

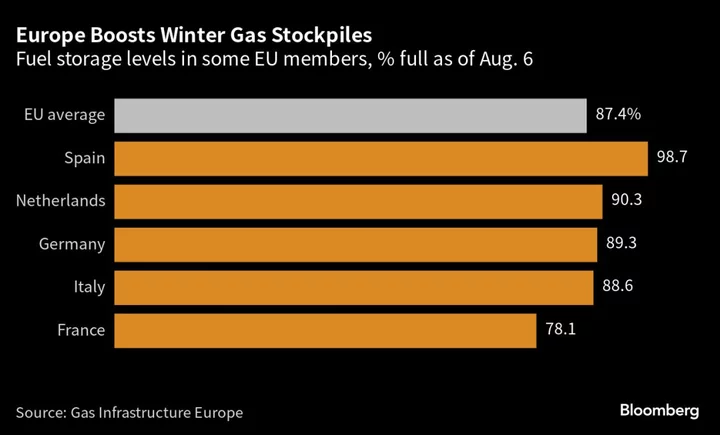

The European Union’s fuel inventories are more than 87% full. That’s the highest level on record for this time of year, data from Gas Infrastructure Europe show, and just shy of the block’s mandatory target to have 90% by November. Some states have already exceeded that level, including Spain and the Netherlands, while Germany and Italy are closing in.

“Record-high gas storage should soften any bullish drivers,” analysts at Alfa Energy Ltd. said in a weekly note. Those include concerns about continuing maintenance in top exporter Norway, and the worsening conflict between Russia and Ukraine, which have provided some support to gas contracts recently.

France is among outsiders, with storage levels at 78%, after energy supplies to the country were disrupted for several weeks earlier this year by nationwide strikes. Compared to long-term historical averages, the country isn’t experiencing delays — it’s just lagging other EU members that have fuller-than-normal stockpiles.

Still, traders are closely watching supplies, especially after Europe’s liquefied natural gas imports recently dropped to the lowest levels since 2021. US exports of the super-chilled fuel are currently more profitable to Asia in September, October and November, according to BloombergNEF. Global LNG supply may also tighten this month, BNEF estimates.

Dutch front-month futures, Europe’s gas benchmark, traded 2.1% lower at €29.85 a megawatt-hour by 10:32 a.m. in Amsterdam. The UK equivalent contract declined 1.5%.