European equities fell at open on Tuesday as disappointing China data added to concern over the nation’s fragile economic recovery, weighing on stocks strongly exposed to the market.

The Stoxx Europe 600 declined 0.5% by 8:05 a.m. in London as soft Chinese services PMI data weighed, with almost all the sectors in red. LVMH and Hermes were under pressure as China’s slowdown weighed, given the country is estimated to contribute up to a fifth of their annual sales.

Among individual stocks, Partners Group Holding AG jumped after its revenue for the first half of the year beat estimates.

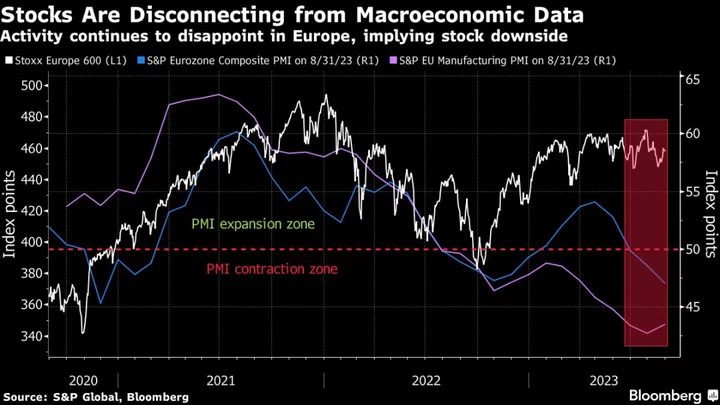

China-led undeperformance follows dismal August, when stocks were under pressure on concerns about Chinese economy, on top of worries that rates will peak at higher than expected levels. Investors are also fretting about slowing growth in the region while inflation remains above the European Central Bank target.

“Investors once again sucked into positioning for a stimulus-led China rebound look to have been disappointed even sooner this time around as the Services Caixin PMI significantly missed expectations,” says James Athey, investment director at Abrdn.

The potential downside risks emanating from China were further highlighted by outgoing RBA Governor Phil Lowe were highlighted as Australia’s central bank kept its key interest rate unchanged and maintained a tightening bias.

While ECB President Christine Lagarde avoided giving an indication of whether the European Central Bank will raise or hold interest rates next week as she delivered a speech in London on Monday. Expected data on Tuesday include PMI figures for France, Germany and Italy.

SECTORS TO WATCH

- European mining stocks may be in focus as iron ore rose to the highest since April, with investors welcoming China’s efforts to aid the steel-intensive property sector and developer Country Garden narrowly avoiding a default.

For more on equity markets:

- Investors Aren’t Seeing a Recovery in Autos Coming: Taking Stock

- M&A Watch Europe: CVC Nears DIF Deal; Rothschild Stake; Renault

- Oman Joins Gulf IPO Spree With Potential Record Deal: ECM Watch

- US Stock Futures Unchanged

- Summer Shines for Low-Cost Airlines: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.