European stocks posted their biggest weekly advance since March on rising bets that the Federal Reserve’s monetary tightening cycle is nearing an end, while the start of a challenging earnings season poses a threat to the rally in the second half of the year.

The Stoxx Europe 600 Index was little changed by the close in London, capping a weekly gain of about 3%. Financial services and tech outperformed Friday, while energy, telecoms and insurance were laggards. The first batch of earnings results from big Wall Street banks broadly underscored the economy’s resilience.

Nokia Oyj slumped after the Finnish vendor of 5G equipment lowered its guidance for 2023. Ericsson AB declined after beating second-quarter earnings forecasts. Partners Group Holding AG gained after it posted a “positive” update on its assets under management, helping offset negative expectations for the firm ahead of the results.

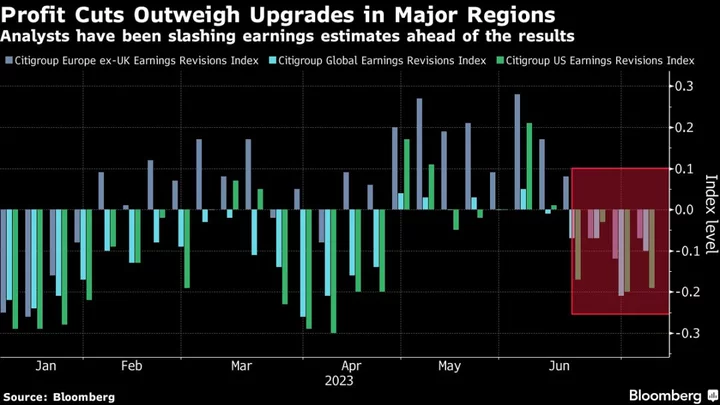

European equities and other risk assets have rallied this week as US inflation eased, fueling optimism that the Fed is close to ending rate hikes. Investors are now focusing on the earnings season — with today being the first major day of reporting — for evidence of whether profits and margins can withstand economic headwinds and slowing consumer demand.

“Markets appear to be pinning an awful lot of hope into one better inflation print in the US, which has helped to lower yield expectations everywhere,” said Michael Metcalfe, head of macro strategy at State Street Global Markets. “But the macro realities of a recession in manufacturing and the broader economy in Europe, along with more sobering messages from earnings should eventually limit some enthusiasm.”

After a strong first half of the year for equities, strategists are getting increasingly concerned that the second half will be more challenging. Major central banks remain stubbornly hawkish as they worry about sticky inflation. This in turn is driving expectations of a recession, which could undermine the stock market rally.

“Softening US core inflation, plummeting producer prices and robust labor market data have really given succor to expectations that we are about to face a historically rather rare immaculate landing — a material disinflation without meaningful economic damage,” said James Athey, investment director at Abrdn. “The challenge of course remains the significant monetary tightening, which is known but not yet acting.”

European equity funds saw $3 billion of outflows in the week through Wednesday, extending redemptions to an 18th week, according to EPFR Global data. Barclays Plc strategists led by Emmanuel Cau said that a majority of their US long-only and hedge fund clients are bearish on the outlook for stocks, especially in Europe. Most US clients have cut exposure to Europe, citing vulnerability to central bank-induced recession, weaker China and the region missing out on the “AI-train,” according to Barclays.

“The apparent cheapness of European equities does not make up for the perceived lack of structural growth opportunities in the region, and appetite for Value appears to be gone for good,” Cau wrote in a note.

For more on equity markets:

- Rising UK Rates Are Turning Into Threat for Banks: Taking Stock

- M&A Watch Europe: Credit Suisse, Exmar, Saverex, ITV, Inwido

- Pulled Deals Show Outlook for European IPOs Is Tough: ECM Watch

- US Stock Futures Little Changed; Theseus Pharma, Leslie’s Fall

- First-Time Buyer Demand Nosedives: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.