There has been a slight reduction in the fear premium being baked into Treasury bills that are most at risk if lawmakers fail to resolve the debt-ceiling crisis, but anxiety remains elevated as Democrats and Republicans continue to wrangle over the borrowing limit and the window for reaching a deal continues to narrow.

Yields on securities due in early June — the period in which Treasury Secretary Janet Yellen has warned the US might run out of borrowing capacity and be unable to make payments — slipped back Thursday after reaching levels above 7% the previous day. That move came as comments from lawmakers gave succor to those optimistic that an agreement will be reached.

Investors nevertheless remain very wary of them and yields are still firmly above 6%. That’s well above the rate on securities due before June 1, and higher than those that mature later in the US summer.

The broader Treasuries market, meanwhile, continues to be whipsawed by lawmakers’ comments on debt-ceiling talks. A crisis around the debt cap has potential to plunge the economy into recession and so anything that averts that could be positive for risk taking, and negative for havens, although if large spending cuts are part of any agreement the market outcome might be more muddied.Improvements in sentiment Thursday helped spur selling Treasury notes and also saw traders boost bets on the prospect of further monetary-policy tightening by the Federal Reserve. Markets moved to price in another quarter-point interest-rate increase by the Federal Reserve within the next two policy meetings and a more than one-in-two chance that hike could arrive as soon as next month.

House Speaker Kevin McCarthy said Thursday that there’s been progress in talks with the Biden administration but “outstanding issues” remain. While he didn’t specify those, negotiators have been clashing over the scale and length of limits on spending to be included in a bill raising or suspending the debt ceiling.

From Washington to Wall Street, here’s what to watch to gauge how worried observers should be and when they should be concerned.

The Bills Curve

Investors have historically demanded higher yields on securities that are due to be repaid shortly after the US is seen as running out of borrowing capacity. That puts a lot of focus on the yield curve for bills — the shortest-dated Treasuries. Noticeable upward distortions in particular parts of the curve tend to suggest increased concern among investors that that’s the time the US might be at risk of default. Right now that’s most prominent around early June. But it’s not just early June securities that investors are circumspect about. Even if the Treasury can make it past the June danger zone, there are still risks of a default during the US summer if no legislative fix is found. Deputy Treasury Secretary Wally Adeyemo said the US government is incurring extra costs to sell debt as a result of the partisan standoff over increasing the federal borrowing limit.

X-Date Predictions

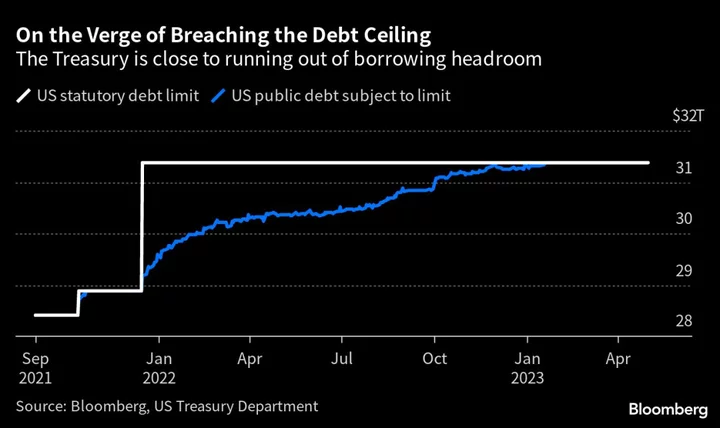

Underpinning the various moves in debt markets are differing estimates about when the government might exhaust its options to fund itself — commonly referred to as the X-date. While the administration has provided guidance that it might fall short as soon as June, prognosticators across Wall Street have also been running the numbers based on government cash flows and expectations around taxes and spending. Most strategists have pulled forward their baseline estimates to align more with forecasts out of Washington, although some remain hopeful that the Treasury might be able to stretch its resources until late summer.

The Cash Balance

The US government’s ability to pay its debts and meet its spending obligations ultimately comes down to whether it has enough cash. So the amount sitting in its checking account is crucial. That figure fluctuates daily depending on spending, tax receipts, debt repayments and the proceeds of new borrowing. If it gets too close to zero for the Treasury’s comfort that could be a problem. The amount of money the US government has to pay its bills actually rose for three straight days, based on the latest figures, providing a modicum of respite as it seeks to eke out funding until a solution can be found to the ongoing impasse. But the broad trend has still been for the total to dwindle. Focus will also be on the so-called extraordinary measures that the Treasury is using to eke out its borrowing capacity. The government has already used up more than two thirds of these accounting gimmicks and had $92 billion up its sleeve as of the middle of last week.

Insuring Against Default

Beyond T-bills, one other key area to watch for insight on debt-ceiling risks is what happens in credit-default swaps for the US government. Those instruments act as insurance for investors in cases of non-payment. The cost to insure US debt is now higher than the bonds of many emerging markets that have credit ratings well below that of the US.