The Federal Reserve on Wednesday will shed some light on the discussions at their June meeting that left Wall Street perplexed.

The Federal Open Market Committee paused its interest-rate hikes after 10 consecutive moves spanning 15 months, even with inflation cooling more slowly than projected. At the same time, policymakers forecast two additional increases this year, more than expected, a confusing result that left investors seeking answers.

The central bank and Chair Jerome Powell “have delivered a muddled message, and I assume it reflects an uncomfortable compromise between the hawks and doves on the committee,” said Kathy Bostjancic, chief economist at Nationwide Life Insurance Co. “The minutes might provide insight on that, but it might simply repeat the awkward explanation Powell has offered.”

Powell has said Fed officials wanted more time to assess economic data in light of aggressive prior increases as well as credit tightening following bank failures in March.

The Fed chief said last week a strong majority of the committee expects two or more hikes and he wouldn’t rule out hikes at consecutive meetings. The minutes could reinforce market expectations for a July hike, said Derek Tang, economist with LH Meyer/Monetary Policy Analytics.

“A July hike is not a given but pretty close, since it gets harder for them to claim the hiking cycle is still alive if they don’t hike two meetings in a row,” he said. Still, “the minutes will keep as much flexibility as it can: a peak rate likely higher, with a wide range of views on proper timing.”

What Bloomberg Economics Says...

“With inflation risks still skewed to the upside, we expect Fed communications to continue leaning hawkish ahead of the July 25-26 meeting.”

— Stuart Paul, chief US economist

To read the full note, click here

The Fed will get two key economic reports before the July 25-26 meeting: the June employment report Friday and readings on consumer prices for the same month on July 12.

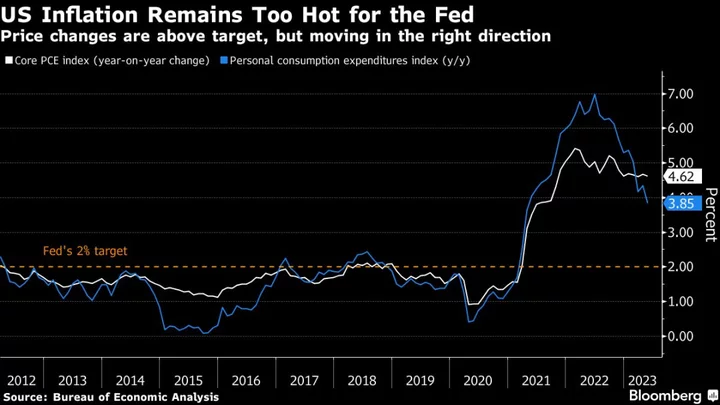

The personal consumption expenditures price index, which is the Fed’s official target, rose in May at the slowest annual pace in more than two years, Commerce Department figures showed Friday.

But policymakers have been more focused on core prices, which exclude food and energy. Those increased 4.6% from May 2022, compared with 3.8% for the broader gauge.

“The problem is that the economy has continued to outperform expectations and inflation has proven to be sticky, which could keep the FOMC leaning hawkish for some time,” said Rubeela Farooqi, chief US economist at High Frequency Economics.

Another key will be the committee’s assessment of lending conditions, which are seen as a headwind to growth following the bank failures.

“In June, there seemed to be enough lingering worry to warrant waiting to see more information about how things are playing out,” said Jonathan Millar, a senior economist at Barclays Capital Inc. in New York. “But if lending conditions are not tightening as expected, then this would be a good reason to deliver another couple of hikes in the next two meetings.”