Federal Reserve Bank of Richmond President Thomas Barkin asked for a show of hands: How many business people expect their price increases will be higher in the next year than before the Covid-19 pandemic? About two-thirds of the group raised hands.

“Come on guys, I’m just trying to control inflation,” Barkin said Oct. 14 to a group of 120 business people in the small town of Westminster, South Carolina. “The bad news I hear is the price genie has been taken out of the bottle, and it’s hard to put it back in.”

The exchange highlighted how Fed officials led by Chair Jerome Powell are increasingly seeking real-time, on-the-ground information about the US economy – not from hard data crunched by government statisticians but from feedback from ordinary business managers and consumers.

The anecdotes — some collected systematically by Fed researchers and published monthly, some ferreted out by presidents in field visits – supported policymakers’ view that the US economy was starting to slow late this year, contrary to official data showing heated growth in the third-quarter.

As Barkin’s experiment showed, they also reveal continued inflationary pressures, even as the consumer price index was unchanged in October.

“Inflation is a big issue,” said Dari McBride, president of the Oconee County Chamber of Commerce, a business group for the area including Westminster. “We are just one little cog in the wheel. So I do appreciate his willingness to listen.”

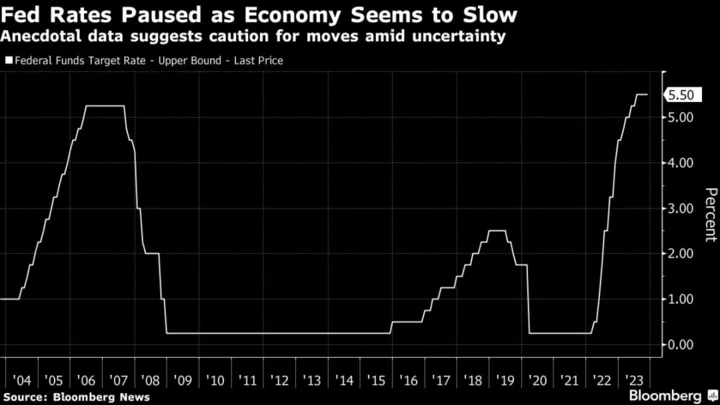

The upshot is Fed officials want to be patient given the increased uncertainties and sometimes conflicting stories from anecdotes and official data. Policymakers raised rates by more than 5 percentage points in the most aggressive hiking cycle in 40 years, but have held them steady since July and show no interest in cutting them any time soon.

“We’ve definitely noticed more discussion of the anecdotal data,” said Jeremy Schwartz, senior US economist at Nomura Securities International. “The patience and wait-and-see approach is kind of upstream of the conflict between the hard and soft data.”

Fed officials say the anecdotes can be especially powerful in assessing the course of the economy and inflation at turning points. And with rapid changes in financial conditions, including a surge and subsequent decline in the 10-year Treasury yield and other borrowing rates, the hard data can seem out of date.

Economic reports “are often backward looking and subject to revision,” Dallas Fed President Lorie Logan told business economists Oct. 9. “My conversations with business leaders provide a critical complement to the hard data. This has never been more true than in recent months as the economic picture has become more complex.”

While the Federal Open Market Committee has had to repeatedly upgrade its forecasts for economic growth in 2023, Fed officials visiting communities in their districts have come away with a mixed picture.

Philadelphia Fed President Patrick Harker, speaking to a group of bankers on Oct. 16, cited his conversations with business contacts and financial firms to explain why policymakers should hold off on further rate hikes.

“Small firms are really struggling with access to capital,” he said. “Some of the bankers I’ve talked to are concerned that their business plans just aren’t going to be able to make it at the higher rates. I heard that warning a lot over the summer.”

The official data and feedback from employers also point to moderation in the labor market, though many industries and sectors are still struggling to fill jobs.

Atlanta Fed President Raphael Bostic says most business contacts he’s spoken with in the Southeast aren’t planning big expansions of their labor forces. But he got a first-hand view of an employment boom in a visit Nov. 9 and 10 to Mobile, Alabama, where the port is expanding, an aircraft manufacturer is adding jobs and construction jobs are unfilled.

Mobile Chamber President Bradley Byrne, who hosted Bostic, said his message to the Fed leader was that the biggest challenge is “workforce, workforce, workforce.”

While nationally job growth is slowing, “We’ve seen the opposite. We’re speeding up,” he said.

Because many potential workers don’t have transportation, Alabama businesses are organizing a pilot project to provide regular transportation for them, a program Byrne described as “Uber for workers.” It’s an innovative way to try to boost labor force participation, which could allow the economy to grow more rapidly without inflation.

Beyond official visits, regional officers from the Atlanta Fed regularly meet with executives to gather insights for the bank’s Regional Economic Information Network, quizzing them about demand, employment needs and investment plans. Bostic, in visits, urges business people to take calls from his executives to discuss details of their businesses.

“Presidents like Bostic have built a whole infrastructure to do this very systematically,” said Julia Coronado, MacroPolicy Perspectives LLC founder and former Fed economist, who sees the anecdotes as reinforcing caution. “This is not just random anecdotes. This is a systematic collection of data on the ground that he has found useful as a leading indicator of the official data.”

It was the downbeat tone of the Fed’s Beige Book report on Oct. 18 that pointed to the economy having “stable or having slightly weaker growth,” contrary to the official growth data, a view Fed officials endorsed with their Nov. 1 rate pause.

While markets have started to price in interest-rate cuts as soon as May 2024, the anecdotes that Fed leaders are collecting suggest patience, and may argue against any near-term moves.

Powell visited York, Pennsylvania, on Oct. 2 as part of his own listening campaign, where he got an earful about high prices from the owner of an orchard and farm and a maker of bath and body products.

“People are really suffering under high inflation,” Powell recalled in a press briefing Nov. 1. “We talked to some people who were feeling that in their businesses and other people who were feeling it in their home lives as well. It’s painful for people” and “that did come through very clearly in the conversations we had in York.”

--With assistance from Catarina Saraiva, Jonnelle Marte and Laura Curtis.