The world’s major central banks meet in the coming week to set monetary policy amid continued signs that the worst inflation crisis in decades is easing.

While the Federal Reserve and European Central Bank are each expected to raise interest rates by 25 basis points, the greater focus will be on signaling from policy makers on whether more hikes are likely — or if they plan an extended pause.

Both Fed Chair Jerome Powell and ECB President Christine Lagarde have warned that inflation remains too high, forcing them to raise borrowing costs further. But with neither central bank meeting again until September, economists say the outlook for policy into the back end of the year remains open-ended.

The Bank of Japan remains the outlier, with more than 80% of analysts polled expecting Governor Kazuo Ueda to continue pumping support into the world’s No. 3 economy even as inflation remains above their 2% target.

Here’s a look at the major central bank decisions due this week:

Federal Reserve

Fed policymakers are poised to hike rates Wednesday to the highest rate in 22 years, while retaining a tightening bias that signals the possibility of an additional move later in the year.

The Federal Open Market Committee is expected to raise rates quarter point to the 5.25%-5.5% range, an 11th increase over the past 16 months. The rate decision will be released at 2 p.m. in Washington. Powell holds a press conference 30 minutes later.

The July hike follows a pause in June that was intended to slow the pace of increases as rates approach a level believed to be restrictive enough to return inflation to the 2% target over time. Still, Powell and other policymakers will want to sound resolute and keep options open to hike again if necessary to avoid recurrences of surging prices.

“Inflation is slowing, but not quickly enough for the Fed,” said James Knightley, chief international economist at ING Financial Markets LLC. “With the jobs market remaining firm, officials are taking no chances.”

What Bloomberg Economics Says:

“Mixed economic data since the mid-June meeting likely failed to settle the internal debate about whether July’s should be the last hike. We believe many FOMC members still expect one more rate hike this year, but June’s soft inflation data may have weakened their conviction.”

—Anna Wong, chief US economist. For full analysis, click here

Market view: Investors are betting on a quarter-point increase from the Fed on Wednesday, which market pricing implies will be the US central bank’s final hike of its tightening cycle.

European Central Bank

With a quarter-point rate hike this week all but guaranteed, all eyes will be on how Lagarde characterizes the ECB’s policy plans beyond July. Officials have stressed for some time that decisions will be based on incoming data, and September may be the first month where they actually stick to that idea.

Saying nothing would break with a well-established habit of de-facto pre-committing to the very next move. Such a change in tactic may become necessary, though, as the ECB approaches the end of the most aggressive tightening cycle in its 25-year history.

Policymakers have lifted the deposit rate by 400 basis points since last July, and economists surveyed by Bloomberg expect two more steps, in July and September, which would take the benchmark to 4%.

Most of that tightening still has to reach the economy, and much of the recent public debate has focused on whether what’s already in the pipeline will be sufficient to bring inflation back to 2%, or if more is needed.

While a fresh survey of banks’ lending behavior on Tuesday will likely show that loan demand and credit standards deteriorated further in the second quarter, underlying price pressures remain unexpectedly strong.

By the time the Governing Council comes back from its summer break in September, it will be able to draw on two more inflation reports, an overview of the economy’s performance in the second quarter, and updated projections — along with several other sets of data — to make up its mind.

What Bloomberg Economics Says:

“The ECB is likely to focus on three key actions at its next meeting on July 27. Lagarde will probably announce another 25 basis-point rate increase, communicate that the decision in September will depend on the data, and emphasize that rates won’t be cut anytime soon.”

—David Powell, senior economist. For full analysis, click here

Market view: Investors are almost fully pricing a quarter-point increase from the ECB on Thursday. Market focus is on the prospect for an additional hike at a subsequent meeting, with the deposit rate seen peaking around 4%.

Bank of Japan

Ueda continues to signal that a major pivot toward tighter policy is some ways off, even as prices continue to rise at a faster pace than the BOJ’s 2% inflation target.

More than 80% of economists surveyed by Bloomberg now see the central bank leaving all its policy levers untouched on Friday. The remainder expect another widening of the band around the BOJ’s yield target, or a similar tweak. The previous survey showed around a third forecasting change in July.

Still, lingering price stickiness is widely seen prompting the BOJ to raise its inflation forecast for this year. That looming revision has been one of the main sources of speculation that the BOJ would tinker with its stimulus measures in July. People familiar with the matter told Bloomberg that officials see little urgent need to address the side-effects of its yield curve control program at this point, although they expect to discuss the issue.

But the market chatter has weakened as Ueda continues to reiterate his assumption that, for now, the price goal looks some distance away. Barring a surprise this week, BOJ watchers now view the next release of quarterly price projections in October as the most likely timing for any move.

What Bloomberg Economics Says:

“We don’t see Ueda springing a Kuroda-style surprise and tweaking the yield-curve settings at the end of the Bank of Japan’s July 28-29 meeting, as some have speculated. Until the BOJ can confirm demand is strong enough to fuel sustainable inflation, Ueda will want to avoid any hasty changes that might be seen as hawkish. We expect the BOJ stand pat at next week’s meeting and through the first half of 2024.”

—Taro Kimura, senior economist. For full analysis, click here

Elsewhere in the world economy this week:

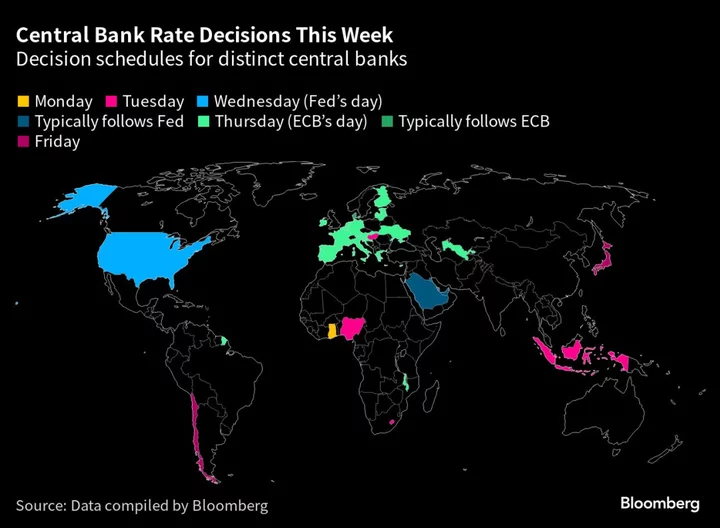

- Rate decisions are also scheduled in Indonesia, Hungary, Ukraine, Uzbekistan, Chile, Nigeria, Ghana, Malawi and Lesotho.

- Additionally, Fed moves are typically mirrored by central banks across the Middle East, while ECB hikes are followed in Denmark.

- The International Monetary Fund presents its new economic outlook.

- Flash PMI readings are due for the US, the euro area, Germany, France, the UK, Japan and Australia.

- South Korea releases second-quarter GDP figures on Tuesday, the US on Thursday, and France and Spain on Friday.

- Inflation readings are due for Australia, Malaysia, Singapore, Vietnam and Tokyo in Asia, for Germany, France and Spain in Europe, and for Mexico and Brazil in Latin America.

- China’s industrial profits will be closely watched for signs of improvement after a dismal few months of falls.

- Turkey’s new central bank governor, Hafize Gaye Erkan, presents the organization’s inflation-outlook report for the first time since her appointment last month.

- Read more from Bloomberg Economics on the economic week ahead in the US, EMEA, Asia and Latin America.

--With assistance from Steve Matthews, Jana Randow, Paul Jackson, Robert Jameson, Sylvia Westall, Greg Ritchie, James Hirai and Kate Davidson.