Federal Reserve Bank of Dallas President Lorie Logan said the recent surge in long-term Treasury yields may mean less need for the US central bank to raise its benchmark interest rate again.

“Higher term premiums result in higher term interest rates for the same setting of the fed funds rate, all else equal,” Logan said Monday in remarks at the National Association for Business Economics meeting in Dallas.

“Thus, if term premiums rise, they could do some of the work of cooling the economy for us, leaving less need for additional monetary policy tightening.”

In bond investing, the term premium is often defined as the extra compensation that investors require for bearing interest-rate risk over the life of the bond. Logan said “there is a clear role for increased term premiums in recent yield curve moves,” though “the size and persistence of the contribution are subject to uncertainty.”

Read More: How Rising Rates, US Debt Brought Back Term Premiums: QuickTake

On the other hand, “to the extent that strength in the economy is behind the increase in long-term interest rates,” the central bank may need to tighten more, Logan said.

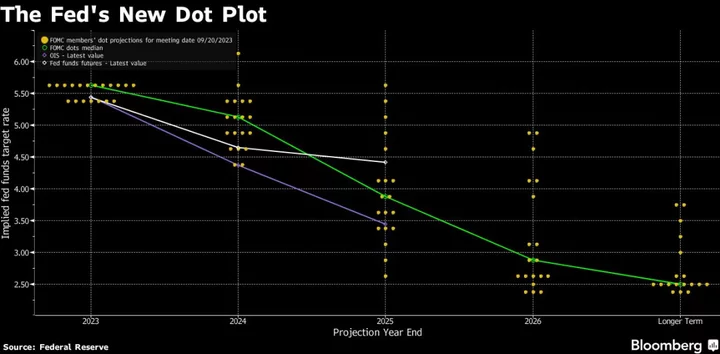

Fed officials are trying to decide whether they need to hike their benchmark federal funds rate again this year after raising it by more than five percentage points over the last 19 months. They left it unchanged at their last policy meeting in September, though 12 out of 19 officials signaled they expected to support another increase this year, according to projections released following the gathering.

Longer-term interest rates have risen since the September meeting as markets adjust to the Fed’s message that the benchmark is likely to remain high for longer than previously thought. The yield on 30-year Treasury securities rose above 5% last week, the highest since 2007.

Too High

“Inflation remains too high, the labor market is still very strong, and output, spending and job growth are beating expectations,” Logan said. “I anticipate that we will need continued restrictive financial conditions to return inflation to 2% in a timely way.”

In answer to questions after her speech, Logan said “we have more work to do and I think restrictive financial conditions will be will be needed for some time.”

Logan, who has been mostly supportive of higher rates since taking the top job at the Dallas Fed last year, said in her speech that inflation was still the most important risk facing the US economy.

“I remain attentive to risks on both sides of our mandate,” she said. “In my view, high inflation remains the most important risk. We cannot allow it to become entrenched or reignite.”

She said there has been “welcome progress on inflation” but monthly data “have been somewhat uneven.”

Logan also referred to the labor market as “very strong overall” following a monthly Bureau of Labor Statistics report out Friday which showed stronger-than expected employment growth in September.

“The most important thing is that we stay focused on on restoring price stability, and I think that will require some rebalancing in the labor market,” she said during the Q&A.

Investors currently see less-than-even odds of another rate increase this year, according to futures. Logan’s comments Monday jibed with recent remarks from San Francisco Fed President Mary Daly, who suggested on Oct. 6 that “if financial conditions, which have tightened considerably in the past 90 days, remain tight, the need for us to take further action is diminished.”

(Updates with comments from Q&A beginning in ninth paragraph.)