The City of London has fewer finance jobs to offer after a post-pandemic hiring boom left companies overstaffed while economic uncertainty caused a sense of gloom among workers and businesses alike.

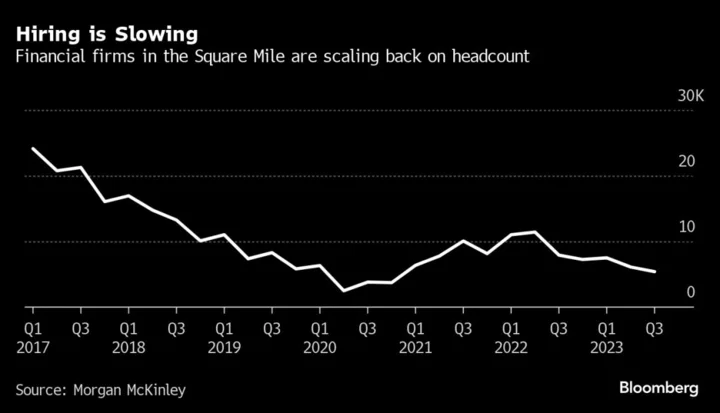

Financial services job postings in the Square Mile dropped almost a third in the quarter through September from a year earlier, according to a report published by recruitment consultancy Morgan McKinley. The decline extends a downward trend in vacancies seen since the end to the hiring frenzy of 2021 and early 2022, when financial firms were desperate to bolster their workforce.

“Many firms ended up with too many people and spiraling salaries caused falling staff attrition rates and reduced demand with lots of underutilized employees,” Hakan Enver, Morgan McKinley UK’s managing director, said in the London Employment Monitor report.

Many businesses are scaling back headcount to control expenditure amid higher borrowing costs, rising overheads and lack of clarity over a recovery in the global economy. In September, KPMG LLP floated plans to cut UK staff numbers, while rival Deloitte announced it would be culling 800 roles. Barclays Plc and Citigroup Inc. are also among many banks laying off staff.

Negative sentiment has spilled over into the candidate pool too, denting demand for financial services jobs, Morgan McKinley said. The number of job seekers in the City decreased 34% in the quarter from a year earlier as the prospect of long job searches rattled applicants.

That said, institutions are still making business critical hires and workers moving from one organization to another clinched an average salary increase of £11,823, or 20%, in the third quarter, Enver said.

“This highlights financial services firms are still prepared to offer the right salaries in a very tight and candidate short market,” Enver said.