For the first time since the Federal Reserve started raising interest rates almost 18 months ago, the labor market is showing enough cracks to embolden some of the world’s largest bond investors to bet that the tightening cycle is finally ending.

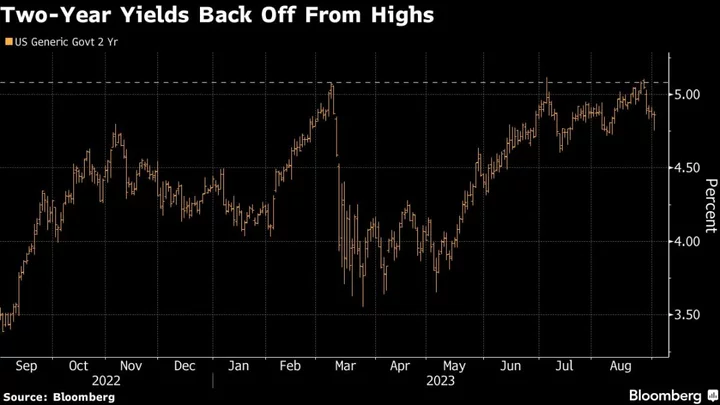

A spate of slowing employment metrics this week, crowned by Friday’s August payrolls report, has shifted market sentiment in favor of owning policy-sensitive two-year Treasuries, which BlackRock Inc.’s Jeff Rosenberg called a “screaming buy.”

The prospect of the Fed wrapping up its most aggressive tightening campaign in decades also drew investors to another favorite end-of-cycle trade — a steepening yield curve. The wager is that as the focus shifts to the timing of a potential Fed pivot to easing, short-maturity notes will fare better than long-term bonds. The strategy may also be benefiting from a seasonal tendency: Companies typically rush to sell debt after the US Labor Day holiday, putting pressure on long-duration bonds.

The jobs data leaves “the bond market comfortable with the view that the Fed is on hold for now and maybe done for the cycle,” said Michael Cudzil, a portfolio manager at Pacific Investment Management Co., which oversees $1.8 trillion. “If they are done for the hiking cycle, it’s then about looking at the first cut that leads to steeper curves.”

While inflation has been trending lower in recent months, a resilient job market has been the main stumbling block for the Fed to stop hiking after raising the borrowing costs by 525 basis points since March 2022, to a range of 5.25%-5.5%.

But now the labor backdrop appears to be cooling. A government report Friday showed that the unemployment rate jumped to 3.8%, a level last seen in February 2022, and wage growth moderated. It was the third soft labor-market release of the week, following weaker-than-expected job openings data and an ADP Research Institute report showing slowing job additions by US companies.

Bond investors cheered the data after a relentless selloff in August saw 10-year yields hit the highest since 2007. The rate, a benchmark for global borrowing, ended the week below 4.2%.

What Bloomberg’s Strategists Say...

“While it would be a little foolhardy at this juncture to completely write off the chance of another rate hike, at this point it doesn’t seem like the Fed will need to go again. That may open a window of opportunity for bonds to rally in nominal terms, though it’s an open question of whether real returns can go positive on the year..”

- Cameron Crise, Macro Man column

For the full column, click here

Short-term Treasuries outperformed on Friday, sending the yield curve steeper. Two-year yields dropped roughly 20 basis points on the week to below 4.9%. Meanwhile, 30-year yields were little changed on the week at around 4.30%, after rising above five-year yields for the first time in weeks.

The employment reports looked like “the beginning of the end of the robust job market and the countdown for how long can the Fed stay on hold,” said George Goncalves, head of US macro strategy at MUFG. “This will favor the front-end versus the back-end,” he said, adding that two-year yields could fall toward 4.5%.

Interest-rate swap traders see slightly less than a 50% chance of another hike by November. After that, they’ve fully priced in a quarter-point cut by June.

As wage growth cools, Rosenberg, a portfolio manager of BlacRock’s $7.4 billion Systematic Multi-Strategy Fund, said the Fed has to lower borrowing costs to avoid the real rate – or inflation-adjusted policy rate – from tightening.

“It is about restrictive policy for longer, not higher for longer,” he said on Bloomberg TV. “That is what the bond market has priced in for next year. A gradual decline in inflation, leaving the Fed to have to cut rates, not because it is a hard landing or because they are overly tight, but because it is avoiding becoming overly tight to maintain restrictiveness.”

Rosenberg said he favors two-year Treasuries as they have both high yields as well as the potential to benefit from a Fed policy shift. Longer-term bonds are less attractive because of uncertainties around inflation and risk premium, he said.

Longer maturities tumbled Friday because traders were bracing for more corporate issuance next week, according to Subadra Rajappa, head of US rates strategy at Societe Generale.

But the curve trade also has the backing of the economic fundamentals, she said.

“The trade to be in is steepeners,” said Rajappa. “Either the market starts to price in more Fed cuts and the curve bull-steepens, or the Fed stays on hold with strong data and long-end sells off in that case.”

What to Watch

- Economic calendar:

- Sept. 5: Factory orders; durable goods orders; capital goods orders

- Sept. 6: MBA mortgage applications; trade balance; S&P Global US services and composite PMIs; ISM services index; Fed beige book

- Sept. 7: Nonfarm productivity, unit labor costs; jobless claims

- Sept. 8: Wholesale trade and inventories; consumer credit; household change in net worth

- Fed calendar

- Sept. 6: Boston Fed President Susan Collins; Dallas Fed President Lorie Logan

- Sept. 7: Philadelphia Fed President Patrick Harker; Chicago Fed President Austan Goolsbee; NY Fed President John Williams; Fed Governor Michelle Bowman; Atlanta Fed President Raphael Bostic; Logan

- Sept. 8: Fed Vice Chair for Supervision Michael Barr

- Auction calendar:

- Sept. 5: 13-, 26- and 52-week bills; 42-day cash management bill

- Sept. 6: 17-week bills

- Sept. 7: 4- and 8-week bills

--With assistance from Katie Greifeld.