Central banks in the US, euro zone and the UK are done raising interest rates for now, but their peers across Europe’s north aren’t so sure.

On Thursday, Sweden’s Riksbank could deliver yet another quarter-point salvo, taking its key rate to 4.25% to fight inflation — or not, depending on who you listen to.

Economists and investors are divided on the outcome, with some arguing that Swedish officials may opt to expand asset sales instead, along with a signal that they may hike again early next year.

The split may very well extend to the Riksbank’s board, which has been unanimous on all but one rate decision since Erik Thedeen became governor in January.

Norway’s central bank — the first in the Group of 10 major currency jurisdictions to start raising rates — may take some comfort from declining expectations on price hikes as well as wage growth. Even so, more tightening is possible at its Dec. 14 decision, not least after a recent acceleration of underlying inflation.

Compared with counterparts such as the Federal Reserve, the European Central Bank and the Bank of England, the Nordics are particularly focused on foreign-exchange pressures.

Swedish policymakers have seen some of their work to rein in inflation undone by relentless krona weakening that makes imported goods more expensive. While the currency has strengthened recently, it remains vulnerable to deterioration.

Similarly in Norway, it’s weakness in the krone, along with recent consumer-price data, that’s led some economists to revise calls from unchanged rates to an increase. “A December hike is fully on,” Nordea Bank Abp analysts Dane Cekov and Kjetil Olsen predicted recently.

One Nordic peer may keep rates on hold this week, but only because it’s done so much already. On Wednesday, Iceland’s central bank is anticipated in its own survey of market agents to keep the benchmark at 9.25%. That’s also the outcome predicted by two of the island’s biggest lenders, Landsbankinn and Islandsbanki.

Policymakers there were the first in the advanced world to start raising rates after the onset of the pandemic — as early as May 2021.

What Bloomberg Economics Says:

“We think a Riksbank hold is much more likely than a hike. That’s an out-of-consensus call and most economists consider the decision to be finely balanced.”

—Selva Bahar Baziki, economist. For full analysis, click here

Elsewhere, central-bank minutes in the US, euro zone and Australia, purchasing manager indexes across the advanced world, and a UK fiscal statement are among the highlights of the coming week.

Click here for what happened in the past week and below is our wrap of what’s coming up in the global economy.

US Economy

The Federal Reserve on Tuesday will issue minutes from officials’ last policy meeting. At a press briefing after central bankers held the line on rates, Chair Jerome Powell hinted that policymakers may remain on the sidelines as they assess the economy and inflation.

The US economic data calendar is light during the Thanksgiving holiday-shortened week.

Figures Tuesday are expected to show sales of previously owned homes remained weak in October, when mortgage rates approached 8%.

On Wednesday, the government will report on weekly jobless claims and October orders for durable goods.

S&P Global’s indexes of manufacturing and services activity on Friday will wrap up the week.

- For more, read Bloomberg Economics’ full Week Ahead for the US

Asia

China is expected to hold its loan prime rates steady on Monday, although economists expect a further cut by year-end amid a patchy recovery for the world’s second-largest economy.

On Tuesday, the Reserve Bank of Australia is set to release minutes from its Nov. 7 meeting, when it decided to resume raising rates.

Governor Michele Bullock and acting head of domestic markets Carl Schwartz are expected to speak that day, with Bullock to deliver a major year-end speech on Wednesday.

Thailand and Singapore are set to report on third quarter gross domestic product on Monday and Wednesday, while Indonesia’s central bank is expected to hold rates steady on Thursday.

Elsewhere, South Korea will release its early trade data on Tuesday, giving one of the earliest looks into the latest state of global demand, and Japan will report on its latest national inflation data Friday. If price growth starts accelerating again, it could have implications for Bank of Japan policy.

- For more, read Bloomberg Economics’ full Week Ahead for Asia

Europe, Middle East, Africa

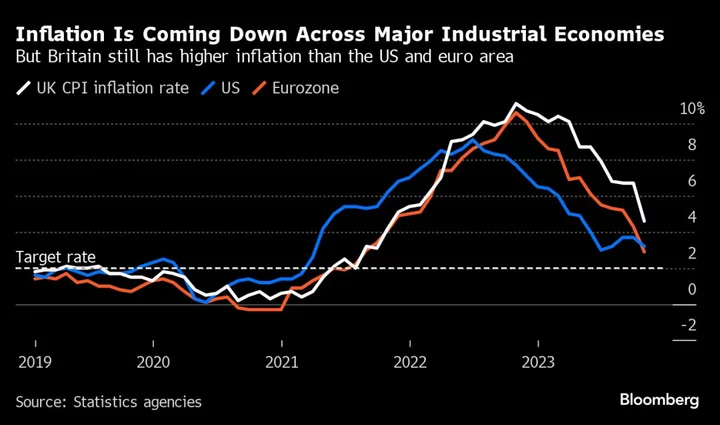

With UK inflation subsiding, Bank of England Governor Andrew Bailey will be quizzed for clues on the monetary outlook in testimony on Tuesday. He’ll appear alongside Deputy Governor Dave Ramsden and two other policymakers, Catherine Mann and Jonathan Haskel.

The next day, Chancellor of the Exchequer Jeremy Hunt of the Conservative Party will unveil his Autumn Statement in a pre-election opportunity to make a dent in Labour’s poll lead.

He’s preparing a growth-focused package to boost investment and tackle issues such as labor-supply shortages and improving the electricity grid, according to people familiar with the matter.

Hunt could also extend a major business tax break, while hitting large retailers and supermarkets with higher bills as post-pandemic business rates relief expires.

Public finances will come to the fore in the euro region too. The European Commission will publish budgetary recommendations on Tuesday for European Union members — a report with significance just weeks before the bloc’s 3% deficit limit is reinstated.

Finance ministers have yet to agree on a framework to interpret that rule, and could meet on that just as European Central Bank officials get nervous on the lack of an accord.

Prospects for public finances might feature, too, at an appearance by ECB President Christine Lagarde on Tuesday in Berlin, where she’ll speak about Germany’s history of hyperinflation alongside Finance Minister Christian Lindner.

Further comments from her are due on Friday, and remarks by several other policymakers are on the calendar throughout the week.

The ECB will release its latest assessment of financial stability risks on Wednesday, followed the next day by minutes of its October rate decision.

Among key data will be euro zone consumer confidence on Wednesday, purchasing manager indexes in the euro area and the UK on Thursday, and Germany’s Ifo business confidence gauge on Friday.

Elsewhere in Europe, rate meetings will draw attention, with decisions in Sweden and Iceland and one in Hungary too. Officials in Budapest may cut the key rate by another 75 basis points, resisting government pressure to do more.

In Africa, major oil producers Nigeria and Angola are expected on Tuesday to raise borrowing costs in an effort to rein in inflation stoked by foreign-exchange weakness and the removal of fuel subsidies.

On Wednesday, Zambia is forecast to increase rates for a fourth straight time as a currency plunge stokes inflation in Africa’s second-biggest copper-producing country.

In South Africa, data will likely show inflation edged closer to the upper limit of the central bank’s 3%-to-6% target range amid rising food and transport costs. That’s unlikely to persuade policymakers of Africa’s most-industrialized economy to increase borrowing costs on Thursday, as it’s predicted to be short-lived.

Turkey’s central bank is poised to raise rates for a sixth straight time on Thursday after more than quadrupling its benchmark since June. The key rate will likely reach near 40%, a level investors say could unlock inflows into the country’s bond market.

- For more, read Bloomberg Economics’ full Week Ahead for EMEA

Latin America

Chile’s economy likely swung from a shallow contraction in the three months through June to a slight expansion in the third quarter, thus avoiding a technical recession on the sustained recovery of the mining industry, especially production of copper, the nation’s top export.

Peru’s economy is heading in the other direction, as declines in mining and construction probably saw output decline for a third straight quarter from a year earlier. Latin America’s fastest growing major economy for much of this century may contract in 2023 overall.

Argentina’s presidential election Sunday — offering voters a choice between Economy Minister Sergio Massa and libertarian outsider Javier Milei — is likely to overshadow a light economic calendar. The winner will confront an economy that’s expected to shrink 3% in 2023 while inflation runs at over 180%.

In a raft of data and publications out of Latin America’s second-biggest economy, three items are top of mind for Mexico watchers. Economic activity likely slowed at the margins at the end of the third quarter but more crucially, consumer prices may have ticked higher in early November.

Stealing some thunder from the minutes of the bank’s November meeting, Governor Victoria Rodriguez said on Nov. 13 that Banxico won’t cut rates until macro conditions stabilize, which isn’t expected during the remainder of this year.

- For more, read Bloomberg Economics’ full Week Ahead for Latin America

--With assistance from Vince Golle, Ragnhildur Sigurdardottir, Kati Pohjanpalo, Robert Jameson, Monique Vanek, Paul Abelsky, Yuko Takeo, Piotr Skolimowski, Joe Mayes and Philip Aldrick.