On the eastern side of Bengaluru, the city sometimes called the Silicon Valley of India, sits a campus housing three cube-like glass buildings. Each is 10 stories high, with facades glistening in the strong South Asian sun.

These are the offices of Goldman Sachs Group Inc., home to about 8,000 workers, the bank’s largest venue outside New York. When Goldman set up in the city in 2004, it had roughly 300 people mainly providing IT and other support. Now, its workers are quants and software engineers, building systems for everything from making trades to managing risk.

Across India, the offices set up by multinationals to provide cheap operational support are taking on more sophisticated roles. While the shift has been underway for years, recent economic data highlight a rapid service-sector expansion that many attribute to the offices known as global capability centers.

These GCCs now account for more than 1% of India’s gross domestic product. But the boom also creates challenges, both for the companies and the cities that host them. Finding qualified employees is becoming more difficult, pushing salaries up, while offshoring may become politically sensitive again in the US presidential race.

“Over the last 30 years, while China specialized in becoming the world’s factory, India specialized in becoming the world’s back office,” said Duvvuri Subbarao, a former governor of the Reserve Bank of India. “Over the years, India moved up the value chain,” he said. But it can’t “take its comparative advantage for granted.”

India has roughly 1,600 of the centers, more than 40% of the number worldwide, according to Nasscom, a trade body for the country’s technology industry. Dotted around Bengaluru, formerly known as Bangalore, are the offices of luxury retailer Saks Fifth Avenue Inc., aircraft-engine maker Rolls-Royce Holdings Plc, US bank Wells Fargo & Co. and Japanese e-commerce firm Rakuten Group Inc. Some 66 global companies set up their first GCC in India in 2022. Even the lingerie brand Victoria’s Secret & Co. has a Bengaluru GCC.

The offices generated about $46 billion in combined revenue in the fiscal year ended March, more than the output of Nepal.

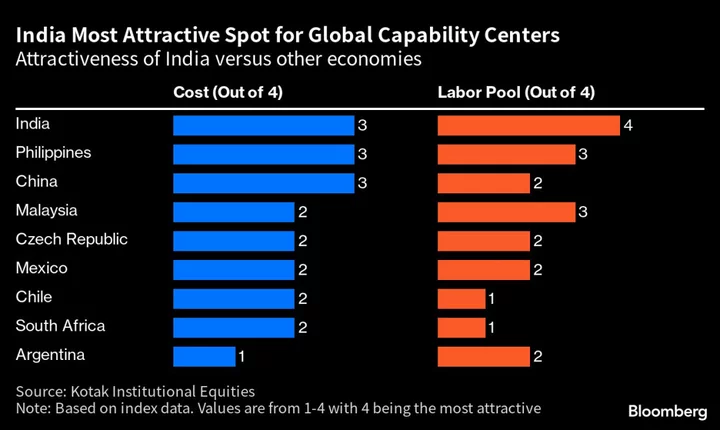

The qualities that turned India into the world’s back office starting decades ago are propelling GCCs’ metamorphosis: a vast pool of young people, an education system that emphasizes science and technology, and the lower staffing costs that made India attractive in the first place. Add an unforeseen catalyst: the pandemic, which convinced decision-makers jobs can be done anywhere, including far-flung shores.

“India’s story starts with its demographics and its talent,” said Gunjan Samtani, the country head of Goldman Sachs Services Pvt, the entity that operates the bank’s GCCs in India. A software engineer by trade, he still codes from time to time. “What brought us here even two decades back was our ability to get access to technology and talent.”

Last year, a mysterious surge appeared in the country’s economic data. Services exports rose to a record for December, leading economists to speculate why. The trend continued. They climbed to about $323 billion in the fiscal year ended March, up 27% from the year before. Analysts reached the same conclusion: It was the GCCs.

Global capability centers have been driving the exuberance in services exports, Pranjul Bhandari, HSBC Holdings Plc’s chief economist for India and Indonesia, and colleagues wrote in a report in March, calling it a “meaningful” shift in India’s economy.

Its significance went beyond the boost in output. The increase helped narrow the country’s current account deficit, which in turn could support a rupee that’s been depreciating for years.

It was an important moment for a business that’s been in the making for decades. Global capability centers trace their roots to the 1980s, when Texas Instruments Inc. established a facility in Bengaluru. India took off as an outsourcing hub in the 1990s, when airlines, technology companies and firms including American Express Co. and General Electric Co. set up centers in the country. The facilities took over business processes including accounting, payroll and customer support, with lower labor expenses allowing companies to cut costs.

The multinationals soon saw they could use their India offices for more than back-office functions. Today, they often handle core operations, such as inventory management or purchasing, while also using AI and other advanced technologies to improve how businesses run.

Retailer Target Corp. is working on new systems for order collection and shipping. At Goldman, engineers have helped develop a trading system called Atlas for quant clients with latency in microseconds. They’ve also expanded a commodities platform called Janus, which provides data analytics.

“The conversation has changed completely,” said Sindhu Gangadharan, senior vice president and managing director of SAP Labs India Pvt. Cost is “a beautiful advantage that we have, but that’s not the conversation starter like it was 20 years back.”

SAP Labs India is now responsible for almost 40% of software firm SAP SE’s global research and development and a quarter of its patents annually, Gangadharan said. Goldman’s GCCs carry out more than 120 global functions across engineering and business operations. JPMorgan Chase & Co. employs more than 50,000 people at GCCs in five locations across India, in areas including quant research, data science and cloud computing.GCCs “are now following a very different path,” said Lalit Ahuja, the founder and chief executive officer of ANSR Inc., a consultancy that has helped clients establish more than 100 of the centers in India. He says he sets up two every month and has never been busier.

The pandemic changed everything by making remote work more acceptable, Ahuja said. The industry came of age in the last few years, he said.

One of India’s biggest attractions is its supply of workers. In April, it overtook China as the world’s most populous country. It’s now home to almost a fifth of humanity, and more than half its population is under 30, with a median age of 28. That compares to 38 in both the US and China.

In a nation obsessed with education, many parents want their children to take subjects that will help them get good jobs and careers. Some 34% of students study science, technology, engineering or mathematics at university, the highest among major economies, according to Unesco Institute for Statistics data.

And these days, India’s thriving startup scene is also a boon for companies setting up GCCs and seeking people to hire. India has about 90,000 startups, the third-biggest number of any country in the world.But the surge in GCCs is making it harder to find employees and creating a need to pay them more. Companies are forming ties with academia to develop hiring pipelines. SAP Labs India has a partnership with engineering school Birla Institute Of Technology and Science, Pilani. Goldman runs an annual contest called GS Quantify for students to find solutions to real-world financial problems. Samtani says the bank gets job applications from more than 1,100 campuses in 20 states.

“The war for talent definitely exists,” SAP Labs India’s Gangadharan said.

Even before competition for staff intensified, companies needed to spend much time training new hires, according to Dileep Mangsuli, executive director and head of the development center at Siemens Healthineers AG, a medical-technology company involved in imaging and diagnostics, which now does half its software and digital-services R&D in India. Good jobs exist in the country, but the booming education industry often doesn’t adequately prepare people to do them.

The employability of new graduates “is still a challenge,” he said. “Till they’re trained and retrained and many times trained, they don’t become employable.”

Read: India’s Junk Degrees Drag World’s Fastest-Growing Major Economy

As GCCs use more advanced technologies, they’re also finding it harder to find staff. An example is artificial intelligence. India has about 416,000 AI workers, far short of the more than 1 million it will need by 2026, according to Nasscom.

Making the most of India’s demographic advantages “will require significant investments and government attention,” said Partha Iyengar, the country leader for research at Gartner Inc. in India. Only 30%-40% of graduates in India are employable, he estimates. “Not enough attention is being given to this, given the massive scale of intervention required,” he said. “If that is not done on a war footing, the demographic dividend can very easily and quickly turn into a demographic disaster.”

The boom is also adding to challenges for India’s cities, especially Bengaluru.

Home to about 30% of the country’s GCCs, India’s tech capital is constantly congested. As work continues on expanding the metro system, large stretches of the city are dug up, resulting in long traffic jams. Last year, torrential rain caused floods across key roads, forcing chief executive officers to ride to work on tractors.

Multinationals are setting up in other places. Hyderabad, a city of more than 10 million people about 570 kilometers north of Bengaluru, is emerging as a popular location. Goldman opened its second India GCC there in 2021 with a focus on consumer-banking services and business analytics. Pune, about 150 kilometers southeast of Mumbai, is another favored destination, as are some areas near New Delhi.

Another risk is that Donald Trump will revive his campaign against offshoring of jobs as he runs for president again in 2024. Data sovereignty — another argument for keeping jobs at home — could also become an issue.

Still, Nasscom estimates India will have at least 1,900 GCCs by 2025, and annual revenue from the industry will increase to as much as $60 billion. “India can overcome the geopolitical challenges because such a large talent pool is not available elsewhere,” said K S Viswanathan, the trade body’s vice president of industry initiatives.

At Goldman, Samtani shares the optimism. He points out the bank had one managing director in the city in 2004. Today, in Bengaluru and Hyderabad, 58 people have reached the coveted rank.

“If India is not part of the talent story for any firm globally, they’re missing something,” he said.

--With assistance from Jane Pong.