This weekend, the Class of 2027 checks into their college dorms at US institutions, from Columbia University in New York City to the University of Wisconsin-Madison to the University of Colorado Boulder.

Many of the incoming students will find college more expensive than they expected, and may realize the financial aid package they received in May will not be enough.

The good news? It's not too late to apply for financial aid or appeal the financial aid amount that was given.

The average cost of attending a four-year college in the United States stands at $25,707 per year, or $102,828 over four years, according to an April report by the Education Data Initiative. Out-of-state students at state schools pay $44,014 per year. At private, nonprofit universities, add a whopping $10,000 per year to that.

Some schools like Northwestern University in Illinois have a "priority deadline" early in the application process for financial aid, but students can still apply year-round. "It doesn't mean that we run out of funding," said Phil Asbury, Director of Financial Aid at Northwestern. "Don't get too discouraged if (deadlines) are already past, you can still apply."

And "showing up in person may even give you an advantage," said Lissett Bohannon, a school counselor at the college match site Niche.com.

"It's actually almost better for students to go into the financial aid office, set up an appointment and meet with them and let the school know of their situation," says Bohannon. While students and their families often just accept the first offer they are given, it doesn't have to be like that, she said.

Here are tips for students on increasing your financial aid package:

Know how much you need

Simply saying that college is more expensive than you thought it would be isn't helpful. Specificity and persistence are what paid off for the University of Chicago's Youssef Hasweh, who was able to get his financial aid offer substantially enriched. How did he do it?

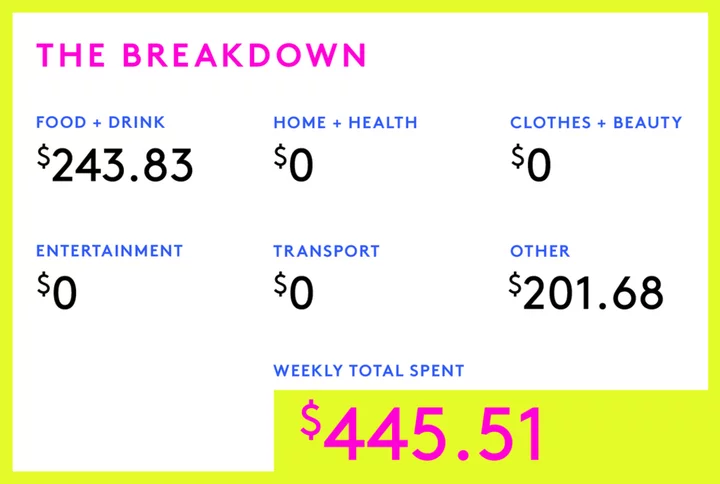

Hasweh told the university it was his dream school, but that he needed help with all of the additional expenses. This included flights, Ubers to and from the airport, and dorm supplies. "Yes, even the shower shoes count as an expense," he told CNN.

Hasweh, who runs a TikTok account dedicated in part to helping students negotiate aid, said the university ended up giving him the extra money he needed.

Pleading backfires, use math

The amount of financial aid students are offered isn't by chance, it's a number reached after using formulas, discussion and a standardized form — the Free Application for Federal Student Aid (FAFSA). So students have to establish why they need more. With the financial aid office, students shouldn't brag or boast about grades. This is about establishing need.

Explain what has changed in your situation

At Emory University, "students can contact the Office of Financial Aid at any point" with what's called "a special-circumstances appeal," said John Leach, Associate Vice Provost for Enrollment and University Financial Aid.

There are a lot of reasons you might get more consideration. "Families might experience a loss of job, a parent illness, accident, or death that might alter their financial situation," said Leach. Inform the school's financial aid office right away and in some cases, financial aid can increase, he said.

Bring proof

Document a parent's loss of a job, for example, or a divorce or unexpected expense. The forms students should bring with them include an income reduction form, federal tax returns and W2 and severance or unemployment benefit paperwork.

"Include a clear explanation of what has changed financially for the student, with any supporting documentation. The opportunity to increase need-based aid depends on the accuracy of your documented financial change and the financial ability of the school to make a change," Leach said.

Replace out-of-date information

This year's FAFSA used 2021 tax return data and now it's 2023, said Vicki Vollweiler, a founder and CEO of College Financial Prep. Vollweiler cited how one of her client's families went through a divorce during the college application process and that student was able to receive an additional $10,000. "Students definitely should file an appeal and the school might be able to help out and offer more in funding," she said.

One other way to cut costs

If your school is no longer accepting appeals, there are other ways students can save some cash in the meantime, said Miranda McCall, Duke University's Assistant Vice Provost and Director of Undergraduate Financial Support. If you are starting to pack the minivan, she suggests taking just the essentials.

"Students who save the most are the ones who take the time to get the feel of the semester and differentiate those must-have items from ones they can cut back on," McCall said. "Don't feel like you must have that perfect room right away or the engineering laptop if you're majoring in English."