Greece’s stocks and government bonds gained at the open as Prime Minister Kyriakos Mitsotakis secured surprisingly strong support in Sunday’s vote, fueling optimism on the outlook for market-friendly reforms.

Prime Minister Kyriakos Mitsotakis’s center-right New Democracy received almost 41% of the vote compared with about 20% for the leftist Syriza party of former premier Alexis Tsipras. While he fell short of achieving a majority in parliament, analysts are confident he will secure a single-party government in about a month, when new elections are expected to be held.

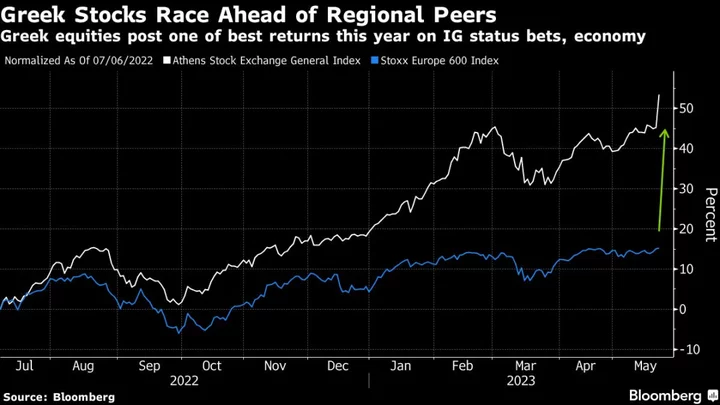

The Athens Stock Exchange General Index rose as much as 6.7% in early trading on Monday, extending its 2023 gains to 29%.

The election has been regarded by analysts and investors as the last obstacle standing in the nation’s path toward regaining the investment-grade rating lost 13 years ago, and a Mitsotakis win was seen as the most market-friendly outcome. In 2022, Greece’s debt-to-GDP fell faster than any other European country.

“The outcome of the vote puts Greece firmly on track to secure an investment grade rating, possibly before the end of the year,” said Wolfango Piccoli, co-president of Teneo Intelligence in London. “While such an upgrade is largely priced in by investors, it will be an important moment as a stigma that has been in place since late 2010 will disappear.”

Greece’s 10-year government bond yield fell about 9 basis points to 3.933%. The rate is down more than 100 basis points since last year’s high, taking down the spread to Italy bonds — a widely followed risk premium — to minus 30 basis points.

--With assistance from Sotiris Nikas and Ksenia Galouchko.

(Adds stocks move)