Banks and the stock exchange in Hong Kong are discussing ways to revive moribund trading volumes.

Regular meetings between Hong Kong Exchanges & Clearing Ltd. and major banks have in recent weeks focused on measures including scaling back the 2021 increase in the city’s stamp duty on stock trading, and improving the design of derivative products, said people familiar with the talks who asked not to be identified disclosing internal matters. Traders are also pushing to cut margin financing costs.

One key change traders are looking for is a reduced stamp duty, which the government raised for the first time in 28 years during the pandemic. Still, the government is unlikely to reverse the increase as the economy remains weak, according to four people who have talked to the HKEX and the government on this topic in recent weeks.

The city’s markets have struggled to recover as China’s economy has failed to rebound as expected after the end of strict Covid restrictions. Initial public offerings in the first-half was the lowest since 2003, after ranking fourth globally last year behind Shanghai, Shenzhen and South Korea.

“Without liquidity, it will be challenging to attract large numbers of issuers to list on HKEX,” especially when China firms face increasing challenges for overseas listings, said Lyndon Chao, head of equities and post trade at the Asia Securities Industry & Financial Markets Association, representing over 165 banks and brokers in the region.

The exchange reports earnings on Wednesday and is expected to show a 37% increase in net income to HK$2.98 billion ($380 million) in the second quarter compared with a weak quarter a year earlier. That represents a 13% quarter-on-quarter drop from the first three months this year. Cash equity trading was down 20% in the second quarter.

Recent moves to stoke activity have fallen short. A new regime that lowered requirements for technology firms to list has so far lured just one company. The launch of a Hong Kong dollar and yuan dual counter has also seen a lukewarm reception. The daily average trading in yuan of the 24 stocks in the counter has accounted for 0.7% of their total turnover as of July 18, according to the Hang Seng Index Company.

Authorities also agreed to launch block trading last week over the Stock Connect link to the Chinese mainland.

HKEX shares have fallen almost 10% this year, compared with a 5.1% decline in the benchmark Hang Seng Index.

The 2021 hike that raised the stamp duty on stock trades to 0.13% from 0.10% made Hong Kong the most expensive exchange among developed markets in the region, based on a $1 million order, an ASIFMA study in November showed. Taiwan, for example, has temporarily halved the securities transaction tax from December 2022 to 2024, triggering a rise in turnover.

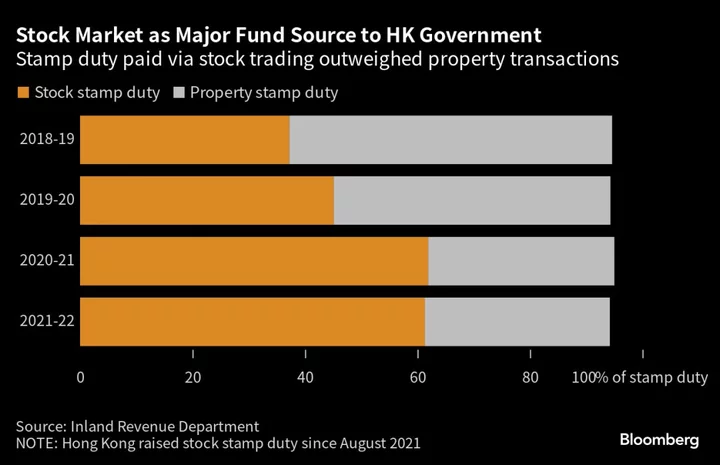

In the last fiscal year, the stamp duty’s annual contribution from stock trading amounted to HK$61 billion, outweighing the income from property transactions, according to the Inland Revenue Department.

A spokesman for the Financial Services and the Treasury Bureau said that the department had found no adverse affect on trading from the new rate on the stamp duty but that stock prices were a bigger influence. “Past experiences also suggest that a cut in the rate of Stamp Duty may not necessarily stimulate market turnover,” he said in a statement.

Traders are also pushing to allow for a cross margin arrangements across products, matching the US practice, said David Friedland, Asia Pacific managing director at Interactive Brokers. Currently, investors with multi-strategy portfolios have to pay for separate margins on stocks, futures and options traded on the same exchange, instead of netting them off to pay a smaller sum.

“Not only do you have to place additional collateral at the exchange but the interest rates paid are less than half of HIBOR which serves to further reduce the efficient use of capital in Hong Kong,” Friedland said. “In short, you need to place more cash with the exchange only to be further penalized via significantly lower than market interest rates.”

Smaller Asks

Inline warrants, a type of structured product introduced in 2019, are supposed to work best in a range-trading market like in recent quarters. Yet setting a minimum six-month expiry date was too long for investors to estimate market direction, reducing the appetite, said Martin Wong, BNP Paribas’s Asia-Pacific head of exchanged traded solutions sales in an interview. A shorter threshold of three months would help, he said.

HKEX is also exploring a plan to bring more over-the-counter products to listing to expand the retail investor base, according to two people. The most feasible option is equity-linked investments. A listing regime has been in place since 2002 but there is no liquidity provider at the exchange. The over-the-counter market for equity-linked products sold at Hong Kong banks to professional investors reached HK$16 billion as of the end of June, according to the Securities and Futures Commission.

A speedier product development cycle could help usher the right product to meet investor demand, Chao of ASIFMA said.

A spokesperson for the HKEX said that the exchange is continuously looking for ways to raise its “competitiveness and attractiveness.”

“Significant progress has been made in all these areas in recent months, and we look forward to working with our partners and stakeholders to make our financial markets even more cost-effective, accessible and efficient, supporting the Hong Kong IFC’s sustainable development,” the spokesperson said.