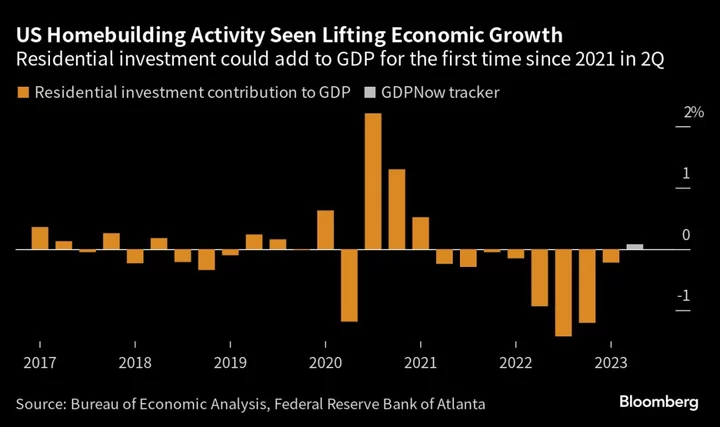

After eight straight quarters of contraction, it looks like the slide in US residential investment may be finished. The nascent rebound now underway is set to remove a major obstacle to ongoing economic expansion.

With new construction activity at the highest level in more than a year, the Federal Reserve Bank of Atlanta’s GDPNow tracker is projecting residential investment added 0.1% to growth in gross domestic product in the second quarter. Though it may not sound like much, that would mark the first positive contribution since early 2021.

The new-home market has been slowly coming out of the woods as falling materials costs and vanishing logistics constraints have allowed builders to work their way through pandemic-era backlogs. Limited availability in the resale market is also pushing many prospective buyers toward new construction, helping support demand even as mortgage rates remain elevated.

“Construction was at the center of the storm for the surge in inflation and the supply-chain turmoil of 2021 and 2022,” said Bill Adams, chief economist at Comerica Bank. “The recent good news for construction makes it easier to imagine a soft or at least soft-ish landing for the economy.”

Government data out earlier this week showed new construction surged in May by the most since 2016, and applications for permits to build — a proxy of future activity — also rose. The unexpected increase sent homebuilding stocks rallying to a fresh all-time high and helped explain why builder sentiment is the most upbeat in almost a year.

A growing number of prospective buyers are opting for new homes amid limited availability in the resale market, where high mortgage rates have had a big impact. Before the pandemic, existing properties made up about 90% of all homes for sale — a number that as of April was closer to 70%.

Monetary Policy

Much continues to hinge on the outlook for monetary policy. The Fed has already raised its benchmark interest rate by five percentage points in a little over a year, and further increases could start to weigh on new-home construction again, said Priscilla Thiagamoorthy, a senior economist at BMO Capital Markets.

“Now that the Fed has continued to signal that rate hikes are still at play, we won’t see further improvement from here,” Thiagamoorthy said. “If rates continue to rise more than one more time, that does risk the chance of a harder landing.”

Another risk is that the number of homes under construction could fall as backlogs ease and applications for permits lag the pace of housing starts. Elevated inventories of new homes could also make builders hesitant to boost output, which risks limiting upside momentum in residential investment.

What Bloomberg Economics Says...

“While the stock market has surged this year and the housing sector appears to have stabilized, the worst is yet to come for credit. A slowing economy will lead to increases in consumer and corporate defaults, which will tighten credit severely for the rest of the economy.”

— Anna Wong, Stuart Paul, Eliza Winger and Jonathan Church, economists

For the full note, click here

Still, after subtracting from growth for the longest stretch since 2005-2009, home construction is finally poised to offer the economy some breathing room at a time when other sectors are starting to cool.

Ahead of this week’s slew of housing data, Wells Fargo & Co. economists were anticipating residential investment to be a drag on GDP growth for the remainder of the year.

“Now, I would say some of the stronger-than-expected housing data means that there’s some upside risk to that forecast,” said Charles Dougherty, a senior economist at Wells Fargo. “We’re not looking for a massive run-up in new construction, but some modest pace seems very likely.”