Hong Kong is reversing an emergency increase in the stamp duty on stock trades as officials seek to revive the city’s status as a hub for finance and initial public offerings.

Chief Executive John Lee detailed the measures — which include lowering the levy to 0.10% again from 0.13% — during the second policy address of his tenure on Wednesday. Stakes are high for the city’s leader to deliver effective support for the financial hub, which is struggling to recover after removing years of pandemic curbs as China’s economic difficulties and increased geopolitical tensions take a toll.

Boosting the city’s financial markets is high on Lee’s list of challenges. IPOs have plummeted since 2021 and trading has slumped, raising concerns about whether other regional finance hubs can effectively overtake Hong Kong’s position as a key international center for commerce.

Lee is also expected in his address to detail significant easing measures for the property market, as falling demand and rising borrowing costs drive home prices down to a six-year low. Developers and real estate agents had been calling for the removal of housing curbs to help that sector.

The levy on stock trades was raised at the height of the pandemic in 2021.

Average daily equity trading on the city’s exchange fell 9% in the first nine months of 2023 from a year earlier. Total equity funds raised declined 67% in the period. Hong Kong’s measures also come after China cut in half its stamp duty on stock trades.

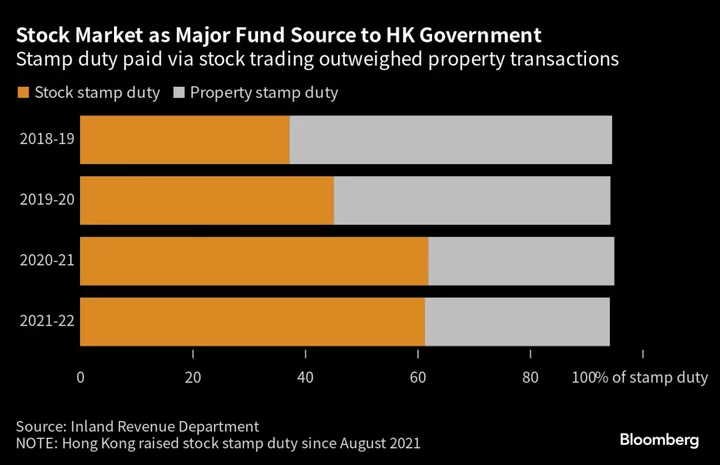

Since the duty was hiked in August 2021, government income from stock trading has surpassed even the revenue it raises from property sales, its traditional cash cow. Hong Kong has also become the most expensive exchange among developed markets in Asia Pacific, a study showed.

The government had earlier expressed reluctance about reversing its higher stamp duty. Before China’s reduction, Hong Kong government said it had found “no adverse effect on trading” from the stamp duty hike and said stock prices were the biggest driver of trading.

Reversing the tariff to levels before the 2021 raise will cut Hong Kong government’s revenue by HK$12.3 billion, or about 2% of revenue, according to an official estimate released in July.

Attention will also be on what Lee does to allay concerns about property. Authorities have room to tweak cooling measures introduced when the sector was red hot. Lee will announce a cut in the home purchase tax to 7.5% from 15% for residents buying a second home, local media reported, citing unidentified people.

Financial Secretary Paul Chan last month also hinted at a potential relaxation, saying conditions have changed from when the government introduced cooling measures in the early 2010s. Prices remain expensive by historical standards, however.

Officials have also been trying to sell Hong Kong’s attractiveness to a skeptical world through various publicity campaigns in order to revive its international image and lure visitors. The number of tourists visiting the city has yet to return to pre-Covid levels, while retail sales remain depressed. Economists have cut their forecasts for the city’s economic growth this year as the post-pandemic recovery remains sluggish.

Yet the government has also ramped up efforts to safeguard national security, even though protests have long been extinguished. In the summer, Lee put a bounty on eight pro-democracy activists living overseas, calling them “street rats” who will be hunted for life. The move triggered public criticism from Western governments including the US and UK.

During his policy address, Lee said the city must stay vigilant against possible street violence and rebellion through “soft resistance,” while watching out for anti-government movements from dissidents overseas. He also said the city would make laws to ban acts endangering national security, which he said would be more comprehensive than existing legislation.

Lee is also expected to tackle the city’s plunging birth rate, which is contributing to a rapidly aging society. Local media has reported the potential for measures including a handout of HK$20,000 ($2,555) for each newborn, along with adding childcare services and providing cash allowances.

Other Key Announcements From Lee’s Policy Address:

- Hong Kong will make laws to ban acts endangering national security according to Article 23 of the Basic Law

- Existing legislation already covers some of those acts, but Lee previously said the new laws would make it more comprehensive

- Hong Kong will introduce a mechanism to attract overseas firms to re-domicile in the city, targeting those with a business focus in Asia Pacific

- Government will study introducing private investors to support large urban development plans, such as the Northern Metropolis

- Hong Kong will attract talent from Vietnam, Laos and Nepal, making it easier for people from there to get talent-related visas

--With assistance from Alan Wong, Richard Frost and Adrian Kennedy.

(Updates to include details from the policy address.)