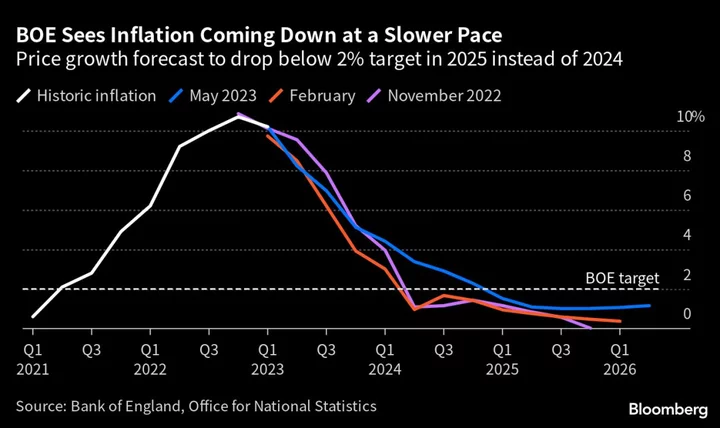

The Bank of England has changed its outlook dramatically since inflation first breached the 2% target in May 2021, including huge forecast adjustments in the past few months alone.

Inflation is now 10.1%, and will still be 5.1% at year’s end, the BOE forecast on Thursday. Even then, it will be higher than the current 4.9% rate in the US. The inflation overshoot and forecast U-turns are raising questions about the BOE’s grasp of where the economy is headed, with its framework and recent track record currently under scrutiny in Parliament.

“It does create a credibility issue,” said Kallum Pickering, senior economist at Berenberg Bank. The forecasts give too much information, causing “self-inflicted confusion” and giving the “impression the bank can predict the future and fine-tune the economy,” Pickering said.

“That has created a credibility trap because neither are possible,” he said, adding that the European Central Bank and the US Federal Reserve face similar challenges.

Here’s how the BOE shifted its thinking as inflation has surged:

Transitory Inflation

Then: In May 2021, outgoing BOE chief economist Andy Haldane warned against letting the “inflation genie” out of the bottle. Governor Andrew Bailey asked whether it was “going to persist or not? Our view is that we don’t think it is.” In July 2021, deputy governor for monetary policy, Ben Broadbent, argued that the BOE should “look through” rising commodity prices and said he was “not convinced that the current inflation in retail goods prices should in and of itself mean higher inflation 18 to 24 months ahead.” It was not until April 2022 that Bailey conceded “if you get shock after shock, then transitory doesn’t look transitory.”

Now: Inflation is now embedded in wage setting and corporate pricing, the BOE said its quarterly assessment on Thursday. That is because, as inflation rises, employees and firms “seek to recoup lost incomes.” Bailey added that higher-than-expected underlying inflation “reflects second-round effects” caused by workers and companies chasing rising prices.

Interest Rates

Then: After the BOE raised rates to 0.5% in February 2022, Bailey said: “It would be a mistake to extrapolate simplistically from what we have done today and assume that rates are now on an inevitable long march upwards.”

Now: Rates have risen for 12 meetings in a row to 4.5%, the highest level since 2008 and the most aggressive tightening cycle since the late 1980s.

Recession Risk

Then: In August, the BOE predicted a five-quarter recession, starting in the final three months of the year. In October, Broadbent pushed back against market interest-rate expectations, saying that, should rates rise to 5%, “the cumulative impact on GDP of the entire hiking cycle would be just under 5% — of which only around one quarter has already come through.” The following month, the BOE warned the UK faced a two-year slump, the longest on record. Even with rates at just 3%, the UK would be in recession, it said.

Now: The economy has not contracted in any single quarter since the summer of last year. After raising rates Thursday, and with a further increase to 4.75% built into the outlook, the BOE delivered its biggest forecast upgrade since independence in 1997. It now says there will be no recession, not even a single quarter of contraction.

Mortgage Pain

Then: In May 2022, Jon Cunliffe, deputy governor for financial stability, said that households would face debt distress with rates at 5%. In its December 2022 Financial Stability Report, the BOE warned that 4 million mortgage borrowers would see their borrowing costs rise this year.

Now: In March, the BOE estimated that just 2.5 million households would see their mortgage costs rise this year. On Thursday, it lowered the estimated again to 2.1 million. It also said households have become more optimistic about their income prospects. Asked about Cunliffe’s warning, Bailey told Bloomberg TV: “It depends on the context of 5%. You can have 5% rates in all sorts of different contexts.”

Rate Votes

Then: The two doves on the nine-member Monetary Policy Committee last voted to raise interest rates in November 2022. Silvana Tenreyro voted for a rate hike to 2.5% and Swati Dhingra for a rise to 2.75%. They were outnumbered and rates were raised to 3%.

Now: They have voted to hold rates at every meeting since, while the rest hiked, but have never voted for a cut. That suggests they believe rates at 4.5% are too high, but have not acted on it.