British companies will be able to release billions of pounds from pension funds for investment under a package of growth reforms that Chancellor Jeremy Hunt will unveil at next week’s autumn statement.

Britain’s pensions lifeboat, the Pension Protection Fund, will also be given new powers to consolidate small retirement plans, according to two people familiar with the plans. The aim is to enable funds to make larger, transformational investments in the UK, said the people, who asked not to be identified discussing proposals that haven’t yet been announced.

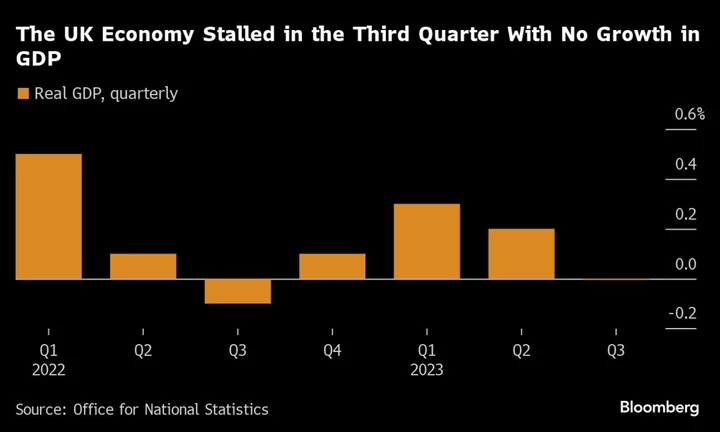

Prime Minister Rishi Sunak’s government hopes the measures will close the UK’s investment gap with Europe and lift Britain’s moribund growth rate — which the Bank of England forecasts will remain stagnant next year. Better economic growth would give the ruling Conservative Party a better story to tell before the next general election, due by January 2025. Sunak’s Tories are trailing by about 20 points in opinion polls.

Hunt has stressed that growth will be his priority at the autumn statement, but with little spending headroom he is trying to draw in private sector money. The Treasury declined to comment.

In July, the chancellor secured a £50 billion ($62 billion) commitment from defined-contribution pension plans to invest in startups and infrastructure.

Defined-benefit plans — which have £1.2 trillion under management, more than double the defined contribution sector — have been identified as another potential source of funds, but because most such programs are closed to new entrants they tend to be invested in low-risk assets like government debt.

For much of the last two decades, investment capital was eroded by funding top-ups to fill ever-expanding deficits in defined-benefit plans caused by falling interest rates. The sharp rise in rates since 2021 has reversed that dynamic and created around £70 billion in surpluses.

Defined-benefit plans provide guaranteed salary-based payments where the employer bears the investment risk. Younger generations tend to be on defined-contribution plans where members bear the risk.

Under Hunt’s reforms, UK businesses will be able to use surpluses on defined-benefit plans — above a protective buffer — to invest in projects or buy back shares.

“The message about surpluses has landed,” said Steve Webb, a former Liberal Democrat pensions minister who is now partner at Lane Clark & Peacock. LCP was one of the industry members that proposed the model.

To make the plans work, Hunt wpi;d have to reduce the 35% tax levied when funds are extracted and offer trustees 100% protection under the PPF in exchange for a “super-premium” paid by the employer. The PPF is funded by the industry.

Although the decision will be announced next week, the government would launch a further consultation to determine the level of protective buffer, the tax rate, and the PPF premium, the people said. There were also questions over what would happen should the protective surplus erode or a sponsoring company go bust.

Hunt will also announce that the PPF will become a consolidator for smaller defined-benefit plans, adding at least £20 billion of assets to the £35 billion it is already running.

The PPF, which takes on failed plans to guarantee that members will get 90% of their entitlement, takes more growth-enhancing investment risk than other defined benefit plans. About one-third of its assets are in private equity, private credit and infrastructure.