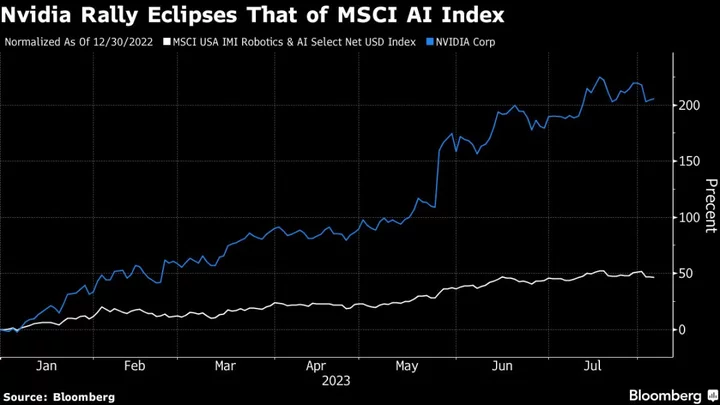

Nvidia Corp. has soared more than 200% this year, and if that’s used as a proxy for the bubble in artificial intelligence stocks, Morgan Stanley reckons the peak in the bull-run is near.

Based on historical context, this stock surge would be in its “later-innings,” Morgan Stanley strategist Edward Stanley wrote in a note. “Bubbles tend to rally a median 154% in the 3 years pre-peak.”

While Nvidia has been the poster-child for the excitement around all-things AI, Stanley says the broader AI benchmarks, like the MSCI USA IMI Robotics & AI Select Net USD Index, have risen far more modestly. The gauge is up 46%.

The Santa Clara, California-based company has been at the heart of this year’s frenzy around AI and its bullish outlook was proof that spending on AI computing is boosting sales.

To be sure, stocks across the sector do not have uniform charecteristics. Therefore, Stanley says that given the idiosyncrasies of individual names, “drawing conclusions on the speed of upswing and drawdown of bubbles can only be usefully or fairly done at an index level.”

--With assistance from Michael Msika.