Indonesia’s central bank is expected to keep its benchmark interest rate steady, while staying on guard against external volatility that could reverse the rupiah’s recent gains.

Of the 31 economists surveyed by Bloomberg, 25 expect Bank Indonesia to leave the seven-day reverse repurchase rate unchanged at 6% on Thursday. The rest see another quarter-point hike to follow through after the surprise increase last month, taking the key rate to its highest since it was introduced in 2016.

Emerging market currencies rallied this month as bets the Federal Reserve has reached the end of its tightening cycle boosts appetite for riskier assets and tempers the rise of the dollar. That’s easing pressure on Southeast Asia’s hawkish policymakers just as economic growth starts to show strain from successive rate hikes. The Philippine central bank stood pat last week and Bank of Thailand is seen to pause on Nov. 29.

However, the rupiah’s recent gains may not be enough to convince Bank Indonesia to shut the door on rate hikes completely especially as the local currency sank 0.9% on Wednesday. It remains up about 2% month-to-date.

“With the rupiah having strengthened since BI’s surprise rate hike on Oct. 19, we doubt there is an immediate need for more tightening,” Brian Tan, an economist at Barclays Bank Plc., wrote in a note this week. He sees a “close call” for a 25-basis point increase in the first quarter in case the Fed tightens again.

Here’s what to watch at Thursday’s briefing from 2 p.m. in Jakarta:

Rupiah Gains

Southeast Asia’s biggest economy has seen a sharp swing in its currency, driven by the market’s risk-on sentiment. The rupiah strengthened along with most major Asian currencies in November, from being the weakest among peers last month. The rebound can also be seen in sovereign bonds, with more than $600 million worth of foreign inflows so far this month.

Supporting the currency’s advance is an easing exports decline that’s put the trade surplus at a six-month high. The booming tourism sector has also helped narrow the current account deficit to about $900 million in the third quarter from $2.2 billion in the previous three-month period.

The rupiah appreciation may be temporary, though, amid the rate outlook for the Fed and geopolitical uncertainties. Should US Treasury yields resume climbing, it could trigger another sell-off in the local currency due to Indonesia’s relatively low interest-rate base and the deficit in the balance of payments, according to PT Bahana Sekuritas.

“We still see the need for Bank Indonesia to hike rates in upcoming months,” said Bahana analysts Satria Sambijantoro and Drewya Cinantyan, who penciled in another 50 basis points of increases through mid-2024.

Market Tools

Bank Indonesia could be reluctant to take the policy rate to a record high as the economy expanded at its slowest pace in two years last quarter. Governor Perry Warjiyo and his board may want to see their newly introduced instruments take a bigger role in attracting foreign inflows and supporting the exchange rate while cautiously keeping rates steady.

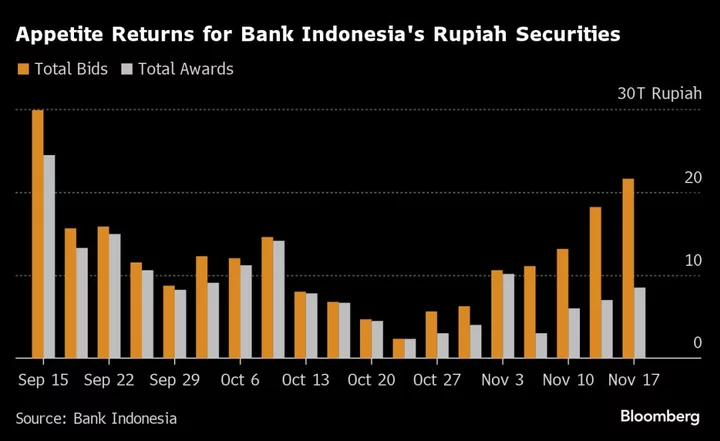

The first auction of Bank Indonesia dollar securities, called SVBI, was oversubscribed this week. The central bank sold $236.5 million of notes, above the $200 million target it set for the maiden sale. Its rupiah-denominated securities, which have been offered since September, have also seen bids rising recently, with more funds coming into their longest tenor of 12 months.

Inflation Risks

Higher global food and energy costs prompted the central bank to raise the 2024 inflation forecast to 3.2% last week, a sizable revision from the 2.8% seen initially and nearing the top end of the 1.5%-3.5% target for next year.

There are early signs of possible price risks. Indonesia’s headline inflation quickened to 2.56% in October as costlier rice pushed volatile food price gains to 5.5%. While core inflation — the gauge BI monitors closely — continued its downtrend, a government spending spree and cash handouts could yet stoke consumer demand toward the year-end.

“BI still carries the view that Fed’s not done hiking while at the same time BI sees upside inflation risks,” said Enrico Tanuwidjaja, economist at PT Bank UOB Indonesia. “Therefore, consistent with our revised view, we keep two 25-basis point hikes in November and December.”