Investors on Wall Street and beyond are betting that the great tech rally of 2023 has staying power, even as they appear skeptical that the artificial-intelligence era will live up to the hype.

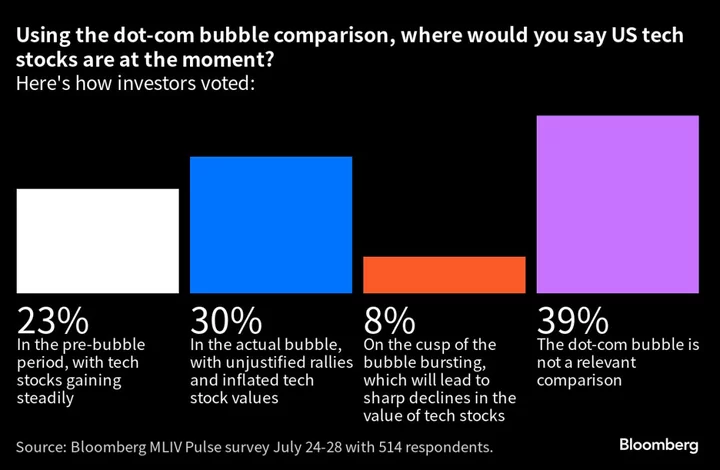

Some 77% of the 514 respondents to the latest Markets Live Pulse survey are planning to either increase their exposure to technology stocks or keep it steady over the next six months. Meanwhile, less than 10% see a bubble in the sector bursting anytime soon. That bullishness has pushed the Nasdaq 100 to its best first half in history, ramping up market valuations and blindsiding pros on the Street.

Yet while survey participants are likely riding the AI-fueled market melt-up thanks to their broad equity exposure, they aren’t going all-in on the technology just yet. Half are disinclined to pay out of their own pocket for AI tools to aid their personal or business life, while a majority of firms aren’t planning on using them for trading or investing ahead.

All that underscores the challenge for companies to generate profits anytime soon from their big investments in the era of OpenAI Inc.’s ChatGPT.

“Right now, the near-term hype is over its skis,” said Ted Mortonson, a technology strategist at Robert W. Baird & Co.

The Nasdaq 100 has soared more than 40% year-to-date, led by the likes of Apple Inc. and Microsoft Corp., as demand for futuristic tech booms. The benchmark now trades at about 25 times estimated earnings, above its 10-year average of almost 21. And senior corporate executives are talking more about AI this earnings season and less about an oncoming recession.

Unlike during the dot-com bubble of the 2000s, AI isn’t entirely based on speculation, given the slew of practical applications that are already in the works, albeit in the early stages. Industry titans have charged ahead with new AI products, hoping to entice corporate clients with tools to boost productivity. Microsoft’s Copilot service integrates into its ubiquitous Microsoft 365 software suite, using generative AI to more efficiently compose emails, summarize documents or crunch numbers.

Microsoft plans to charge $30 a month for the Copilot service. That’s poised to see competition from Alphabet Inc., which is integrating AI features into its own Workspace apps like Gmail and Google Docs. The Google parent company is also introducing new products for advertisers and is testing a tool for news organizations that use AI to write articles.

Nvidia Corp. has become the poster child of the frenzy given its processors are used in computers that power AI applications, rallying more than 200% this year alone. It’s the first chipmaker to boast a $1 trillion market valuation and 29% of MLIV Pulse respondents reckon it’s on course to become the second- to fourth-largest company in the world within the next two years, from the sixth-largest currently.

Yet even as AI makes its way to the workplace, 64% are dismissive of the idea that the new technology will perform core aspects of their job within the next three years. Meanwhile Goldman Sachs Group Inc. economists earlier this year estimated that seven in 10 US workers would see their jobs impacted by AI, yet just a small share of those would see their positions replaced by new technologies. Goldman said office and administrative support and legal functions were among the sectors most at risk.

With oncoming advances in AI, robotics and quantum computing, Ed Yardeni, president at Yardeni Research, said there is a “reasonable” chance that the US economy booms on productivity gains.

“I think this is going to turn out to be something like the Roaring 2020s,” he said in an interview on Bloomberg Television.

The MLIV Pulse survey of Bloomberg News readers on the terminal and online is conducted weekly by Bloomberg’s Markets Live team, which also runs the MLIV blog. This week, the survey asks: Is unlimited Paid Time Off (PTO) the future of work and how will it impact companies? Share your views here.