Italian banks will be allowed to avoid paying a controversial windfall tax introduced last month if they set aside additional capital reserves, according to a government amendment seen by Bloomberg News.

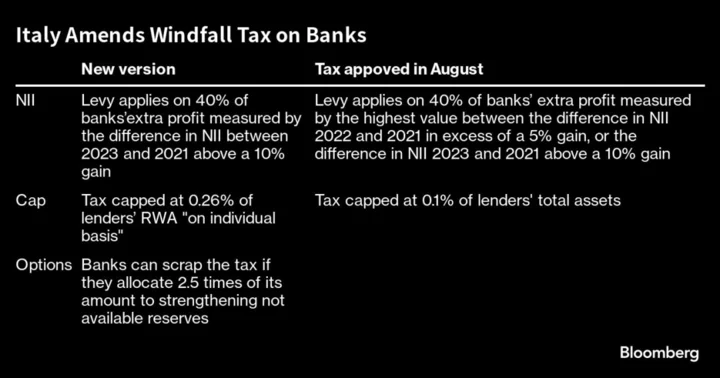

Lenders can opt out of the tax if they allocate 2.5 times the amount owed to strengthening their common equity tier 1 ratio as non-available reserves, according to the amendment. If those reserves are later distributed as dividends, banks will have to pay the full tax plus matured interest, the document says.

The changes, which are widely expected to be approved by parliament and become binding next week, signal a compromise from the right-wing government of Giorgia Meloni following a slump in Italian bank stocks and criticism from the European Central Bank. The levy, which took aim at profits pouring in from higher interest rates, also caused a split in Italy’s ruling coalition, drawing opposition from Forza Italia, the junior party in the government.

The amendment also caps the tax at 0.26% of lenders’ risk-weighted assets on an individual basis instead of 0.1% of their total assets. The levy will apply to 40% of banks’ extra profits measured by the difference in net interest income between 2023 and 2021 above a 10% gain. The new draft has been calculated to generate the same amount of income for the government as the original version of the tax, according to the amendment.

The amended levy will protect savings and market stability and create more credit for families and businesses, Deputy Premier Antonio Tajani wrote late Saturday on X.

It’s positive that the tweaked law includes the possibility of opting for strengthening capital instead of paying the tax, even if it’s still unclear how it will be applied, Nicola Calabrò, Chief Executive Officer of Cassa di Risparmio di Bolzano-Sparkasse, said in an interview with Corriere della Sera on Sunday.

Author: Sonia Sirletti, Daniele Lepido and Alessandra Migliaccio