Ant Group Co. is planning a restructuring that will break off some operations that aren’t core parts of its China financial-related business, according to people familiar with the matter, paving way for the company to revive an initial public offering in Hong Kong.

The company is looking at leaving its blockchain, database management services and international business out of a main entity that will be used to apply for a financial holding license in China, the people familiar said, requesting not to be named. It has relayed the plan to some shareholders, the people said.

Once the restructuring is completed and Ant secures a license for its financial holding company, it can prepare for an IPO in Hong Kong instead of a dual Shanghai-Hong Kong listing that it had pursued before a last-minute intervention by Xi Jinping’s government in 2020, said the people.

The plans have yet to be finalized and may be subject to change, the people said. Ant declined to comment in an emailed statement.

The move comes after Chinese regulators wrapped up an almost three-year long probe into the fintech giant founded by Jack Ma by imposing a 7.12 billion yuan ($995 million) fine this month. The billionaire’s run-in with Beijing has cost his empire — including Ant and Alibaba Group Holding Ltd. — about $850 billion in lost valuation, including what would have been the largest IPO in history.

The proposed restructuring may offer some much-needed relief to shareholders ensnared by the crackdown. They will also be given stakes in the entities left out of the main operation at a nominal price, one of the people said, adding those businesses will take years to grow.

At the same time, the firm has received approval from shareholders to buy back as much as 7.6% of shares at a valuation of about $79 billion. That’s well below its $280 billion market capitalization ahead of the scrapped IPO in 2020, and down from the $150 billion value when global funds including Temasek Holdings Pte and Carlyle Group Inc. assigned to it when they bought in five years ago.

Alibaba Group, which holds a third of Ant, has decided to stay on the sidelines, saying it wants to maintain its slice of an important partner.

Some Chinese state-owned firms that took part in Ant’s earlier funding rounds are planning to participate in the buyback, the people said. Shareholders have until early August to make a decision, according to one of the people.

China’s National Council for Social Security Fund, along with China Development Bank Capital Co., bought into Ant’s private fundraising round in 2015 when the company sold a 12.4% stake to outside investors at a reported valuation of about $45 billion.

IPO Revival

Ant’s current international business includes a transaction network known as Alipay+ that facilitates cross-border payments among a number of digital wallets in a wide range of countries. It also runs WorldFirst, a one-stop digital payments and financial services platform for small businesses that conduct cross-border trade; and ANEXT Bank, a digital wholesale bank in Singapore that started in June 2022.

Listing in Hong Kong would be faster than in Shanghai since Ma announced that he was giving up controlling rights of Ant in January. Companies can’t list domestically on China’s so-called A-share market if they have had a change in control in the past three years — or in the past two years if listing on Shanghai’s STAR market, which is geared toward new technology companies. For Hong Kong’s stock exchange, this waiting period is one year.

Even if Beijing eases up on Ant, the years of relentless scrutiny have taken a toll on the company. Ant’s bottom line has eroded and growth prospects for its operations from consumer lending to asset management have diminished.

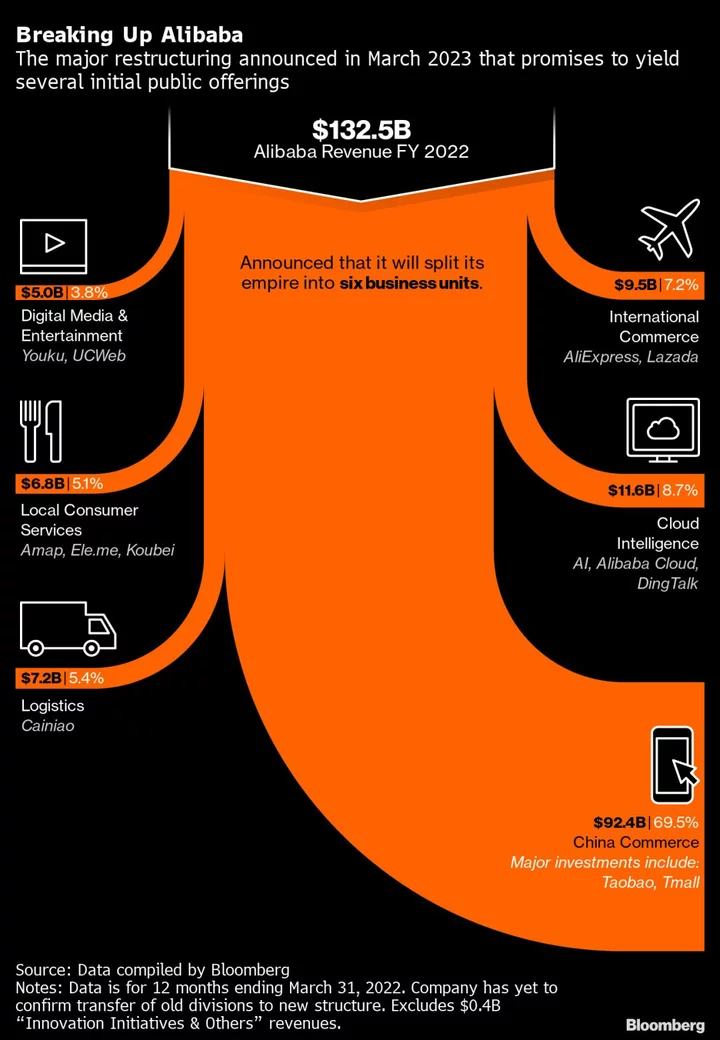

Ant’s split would mirror one of its affiliate Alibaba, which is forming into six main businesses, from cloud services to meal delivery and logistics. While investors initially cheered the potential creation of value, Alibaba’s shares have come off their 2023 highs and have shed about $600 billion of their value since the clampdowns on Ant began.

--With assistance from Zheng Li and Zhang Dingmin.