This year’s rally in Japanese stocks, which has driven the Topix to its highest level in more than three decades, is set to extend as earnings growth, share buybacks and still-low valuations lure buyers.

That’s the view from CLSA Securities Japan Co. and Monex Inc. A promising earnings season has been the latest catalyst for Japan equities, which were boosted by Warren Buffett’s renewed endorsement and corporate governance improvements. Though not spectacular, Topix firms are forecasting operating profits to rise about 6% in the fiscal year ending March 2024. History shows that companies tend to be conservative.

“Earnings seem pretty good, with the important auto sector expecting profit growth,” said Takashi Hiroki, chief strategist at Monex, Japan’s third-largest online broker. “Domestic demand-oriented companies are benefiting from the prospects of an increase in inbound tourism while big banks also had bumper earnings.” Hiroki expects further gains of 10% or more by the end of the year.

Up more than 12% in 2023, the Topix is already among the best performing national equity gauges in Asia and is beating a broader regional index by more than 8 percentage points. Data on Wednesday showing the economy is expanding more quickly than expected is likely to help fuel further gains.

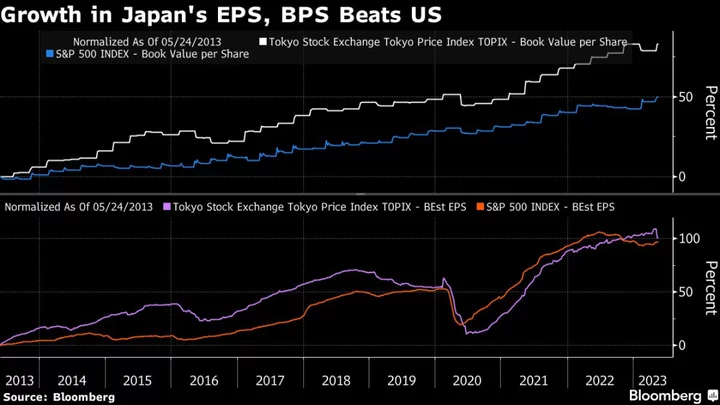

While the Japanese gauge is at a 33-year high, it is hardly expensive given a price-to-book ratio of 1.3 times, compared with 4 for the S&P 500 Index and 1.8 for the Stoxx Europe 600. Cheap valuation is the key reason why Nicholas Smith, a strategist at CLSA, is predicting a further rally of at least 10%.

Goldman Sachs Group Inc.’s chief Japan equity strategist, Bruce Kirk, is also bullish. He told Bloomberg Television on Wednesday that a perfect alignment between the interests of government, regulators and the exchange, along with foreign and domestic investors, could create “one of these policy-driven sustainable bull markets that we get in Japan once a decade.”

To be sure, the global backdrop poses a risk for Japan’s export-driven market. Rie Nishihara, chief Japan equity strategist at JPMorgan Chase & Co., said the debt-ceiling issue in the US could pose a setback.

For now, foreign funds are piling in as concerns about recession in the US and Europe, as well as geopolitical risks surrounding China, turn Japanese stocks into some sort of a haven trade. Share buybacks remain at record levels, with investors expecting more to follow as the country’s stock exchange pushes companies to lift their market values. Buybacks in the US have slowed.

“I don’t expect a runaway bull market, but the market is well backed by fundamental value,” said Peter Tasker, co-founder and strategist at Arcus Investment.

READ: Goldman Sees More Japan Upside as Topix Approaches 33-Year High

Since global stock prices bottomed out on March 15, the Topix has gained 8.5%, the best performance among major markets. The S&P 500 index advanced 5.6% while the MSCI Asia Pacific index added 3.4% in that span.

Masayuki Murata, a general manager of balanced portfolio investment at Sumitomo Life Insurance Co., is taking the long view when it comes to Japan.

“Given that the P/B ratio is still around 1.2 times, even if there is some sort of crisis in markets, it would be a big buying opportunity for long-term investors like us,” Murata said.

--With assistance from Winnie Hsu and Yasutaka Tamura.

(Updates with growth data in fourth paragraph, adds Goldman comments as sixth paragraph.)