A welcome downshift in inflation data has led JPMorgan Chase & Co.’s Marko Kolanovic to soften his stance on a potential US recession.

The bank’s chief global markets strategist, who has warned investors to shun equities amid looming economic risks, said the consumer price index for June has slightly increased the Federal Reserve’s chances of a “soft landing” — or taming inflation without triggering a downturn.

“While we still see the Fed hiking at the July meeting, the downside CPI surprise means a narrow path to a soft landing is modestly wider,” he wrote Monday in a note to clients.

Kolanovic was one of Wall Street’s biggest optimists during much of the 2022 market selloff, before cutting JPMorgan’s model equity allocation in mid-December, January, March and May due to a deteriorating economic outlook.

The view also comes as Goldman Sachs Group Inc. further cut its US recession probability to 20% from 25%, as investors broadly scale back expectations for an economic downturn. Citigroup Inc. strategist Chris Montagu said flows data appear to show traders betting on a soft landing, ramping up their bullish wagers on the S&P 500 Index last week after a flurry of positive economic data.

While Kolanovic said his firm is downplaying near-term recession risks, JPMorgan continues to express skepticism inflation can return to central bank comfort zones on a sustained basis without an economic downturn, he said.

Kolonavic warned that European stocks face risks in the second half of the year from further monetary tightening, a move lower in bond yields and potential upcoming earnings disappointments.

Meanwhile, US small- and mid-cap equities may offer “quite a bit of upside” if inflation falls to 2.5% and interest rates start to come down, he said.

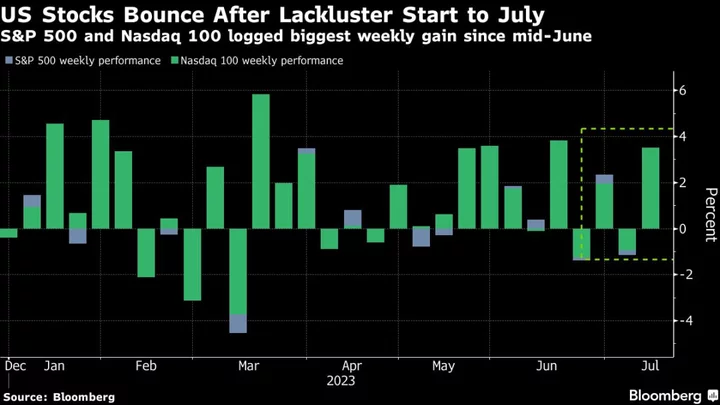

The S&P 500 rose 0.4% Monday as of 3:21 p.m. Monday in New York, bringing year-to-date gains on the benchmark closer to 18%. Still, following a powerful first-half rally, strategists remain torn about whether momentum can persist into the second half of the year.