Kenya is expected to follow other emerging market central banks that have kept borrowing costs steady over the last few weeks as inflationary pressures mount and they weigh risks to their currencies.

Of the 11 economists in a Bloomberg survey, nine including HSBC Holdings Plc and JP Morgan Chase & Co. forecast the monetary policy committee will keep the rate at 10.5% for a second straight meeting on Tuesday. One predicts a cut and another a hike. The Kenya Bankers Association’s research arm is also calling for an increase.

Economists anticipating that the MPC will stand pat see it doing so as inflation, which unexpectedly quickened to 6.8% in September, is forecast to remain within the central bank’s target range for some time and the real rate — the difference between price growth and borrowing costs — is among the highest of 11 economies in Africa and the Middle East tracked by Bloomberg. The decision is expected around 4:30 p.m. in Nairobi.

“Given our expectation for inflation to remain within the 2.5-7.5% target band over the next 12 months, we maintain our view that the MPC will keep the policy rate unchanged,” said Absa Group Ltd. economists Ridle Markus, Mpho Molopyane and Sifiso Mkhwanazi in a research note on Monday.

The pause would follow recent rate holds in emerging markets such as Ghana, the Philippines, Indonesia, Taiwan and South Africa, where policymakers struck a cautious tone after a meeting of the Federal Reserve. The US central bank left its benchmark rate unchanged on Sept. 20 but signaled borrowing costs will likely stay higher for longer after one more hike this year.

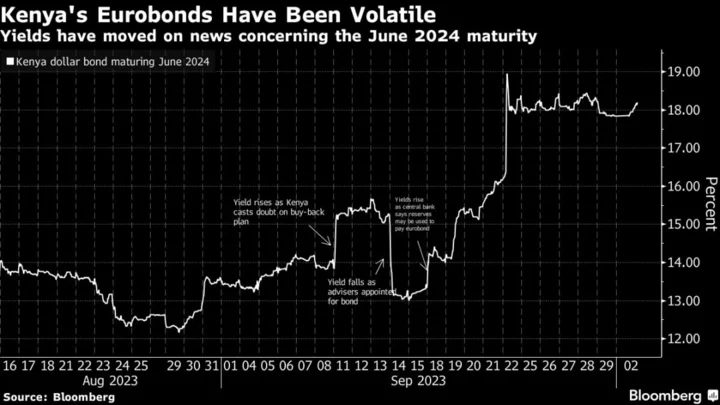

Still, with the oil price back at levels last seen in November and Kenya’s exchange rate declining 3% against the dollar since the MPC’s previous meeting on Aug. 9, partly due to concerns over repayment terms of a $2 billion Eurobond maturing in June 2024, some see scope for a hike.

“Further moderate monetary policy tightening would support measures taken previously to tame inflationary pressures and rising inflationary expectations, cool off credit demand” and help moderate the ongoing “depreciation of the exchange rate,” the research arm of the Kenya Bankers Association, a lobby group of lenders, said.

The MPC meeting will be Governor Kamau Thugge’s third since he took office in mid-June.

(Updates with expected time of the rate decision in fourth paragraph.)