President Christine Lagarde stayed out of the debate over whether the European Central Bank should lift interest rates for a 10th straight time next month — even as some of her hawkish colleagues are trying to nix talk of holding fire.

Remarking in a speech and to Bloomberg TV on Friday, Lagarde didn’t add to her earlier guidance that the Sept. 14 decision could be a hike or a pause.

“It’s critically important that inflation expectations remain anchored at 2%,” Lagarde said in an interview with Tom Keene at the Federal Reserve’s annual retreat in Jackson Hole, Wyoming.

The event has often been used by central bankers as a stage for major policy pronouncements. Last year, officials including Fed Chair Jay Powell and ECB Executive Board member Isabel Schnabel set the tone for a prolonged assault on inflation.

Lagarde’s restraint in laying out a clear path for the coming months contrasts with her predecessor, Mario Draghi. His 2014 Jackson Hole speech put the ECB on course to embark on quantitative easing the following year.

The former head of the International Monetary Fund has been at the ECB’s helm for almost four years, nearing the halfway point in her term. But unlike her predecessor, famous for his “whatever-it-takes” pronouncement, she’s rarely led the way on monetary policy, seeking to build consensus instead.

Gloomy Outlook

Her comments cap a week of dismal data from the 20-nation euro zone. The bloc’s largest economy, Germany, is struggling to bounce back from a recession, while business surveys show the services sector following manufacturing into the doldrums.

The euro was trading 0.2% lower but was well off session lows of 1.0766 after Lagarde spoke. Schatz futures were trading just off session lows, while bund futures also pared losses to trade above the 132.00 level.

Until Jackson Hole kicked off, the 26 members of the ECB Governing Council had been largely disciplined over not tipping their hand on where they stand — making it harder to predict whether hawks are in the majority, though their voices have been heard the most of late.

But, despite the darkening economic outlook, Bundesbank President Joachim Nagel gave his clearest signal in weeks on his stance, telling Bloomberg TV late Thursday that it’s premature to consider a pause in rate hikes with inflation still elevated.

Minutes before Lagarde’s speech, Latvia’s Martins Kazaks offered a similar view, saying he’s leaning toward boosting borrowing costs further, and that officials can always cut later on if needed.

“The risks are now really on both sides — doing too little or doing too much,” he told Bloomberg TV. “But I would still err on the side of raising rates.”

Austrian central bank chief Robert Holzmann the ECB isn’t in the clear on inflation. “My guess is that a little more should be added,” he said. “But the data will decide.”

Some were more cautious. Portugal’s Mario Centeno stressed that downside risks to the economy flagged in recent months are now materializing.

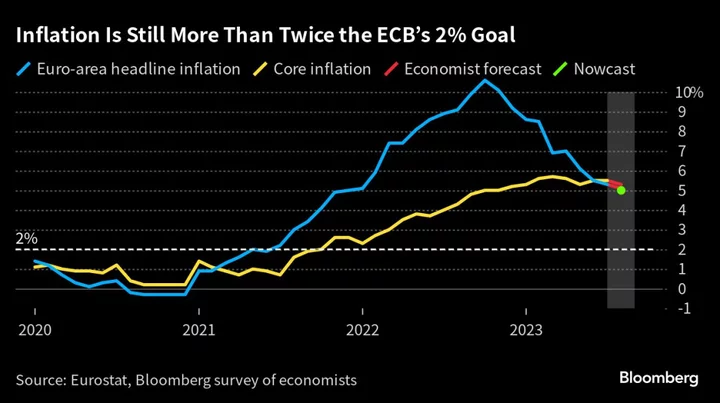

Next week may bring further clarity as Eurostat releases August’s inflation reading. Analysts are expecting a small moderation to 5.3% — still more than double the goal. The closely watched measure of underling price pressures is estimated to recede to 5.1%.

Lagarde reinforced on Bloomberg TV that the ECB is “deliberately, decisively data-dependent” and committed to taking decisions one meeting at a time, particularly because a wide range of structural shifts has made the economy more difficult to read.

“In a way the break of these regularities forces us to have a larger spectrum of indicators and to think in a much broader way about the consequences of what we decide,” she said.

The ECB can’t exclusively rely on the inflation outlook as determined by models, she argued.

“We have to bring into our reasoning and our considerations other elements” such as underlying inflation,” she said. “We also need to measure the impact of our monetary policy.”

--With assistance from Edward Bolingbroke and Carter Johnson.

(Updates with market reaction in eighth paragraph.)