Britain’s intensifying mortgage crunch is now forcing London’s wealthiest home sellers to agree to discounts or risk deals falling through.

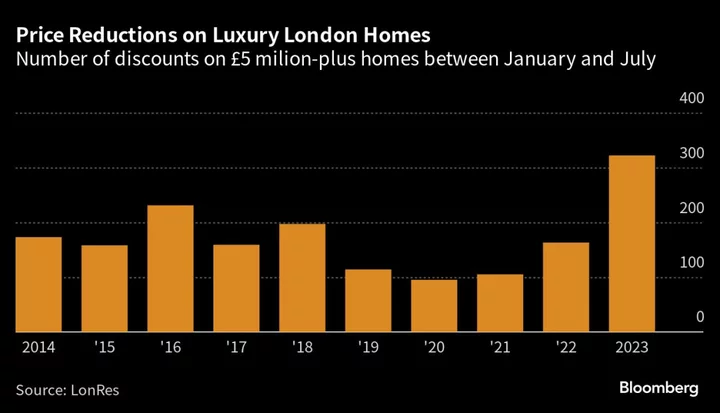

The number of price reductions for deals worth £5 million ($6.4 million) or more almost doubled in the year through July, compared with the same period in 2022, according to a report by researcher LonRes. The data also showed transaction volumes in London’s prime property market — which includes the capital’s most affluent postcodes — dropped by more than a quarter in July, compared with the same month a year earlier.

“While the volatility of the mortgage market has less direct impact in this equity-driven sector, it undoubtedly affects sentiment, creating uncertainty among both buyers and sellers alike,” said Nick Gregori, head of research at LonRes.

Millions of UK homes have declined in value this year on the back of a triple whammy of pricey borrowing, economic uncertainty and the worst cost-of-living crisis in a generation. This has created a gap in price expectations between buyers and sellers in London’s luxury housing market, with some vendors unwilling to knock down their price.

That’s causing more transactions to collapse in the capital, with the amount of £5 million-plus deals falling through rising 15% between January and July, compared with the same period a year earlier. What’s more, the number of properties going under offer in July — billed as a leading sales indicator by LonRes — was about 14% lower than the same month in 2022, as high financing costs prompted some potential buyers to retreat.

Read more: UK 6% Mortgages vs. House Prices: Loan Supply Key in 2023 Battle

Still, the less debt-reliant nature of London’s luxury housing market means the costliest home sales are holding up better than cheaper deals. New instructions for properties priced at £5 million or more were up by almost a third year-on-year in July, compared with a 12.4% drop across prime London as a whole.

And despite the drop in homes going under offer last month, the decline is less pronounced than actual sales. If these deals conclude, the sales figures over the coming months may look healthier, according to LonRes.

“If borrowing costs have settled down by then and the economy starts to perform better, we could see a stronger close to the year,” LonRes’s Gregori said. “But if the recent volatility continues it is likely transaction numbers will remain suppressed and values could come under more pressure.”